ICSI - WIRC FOCUS

Vol. XXX • No. 08 •Sept 2013

Chairman’s Blog

My Dear Professional Friends,

My Dear Professional Friends,

Greetings

The month of September was full of activities at WIRC and at all levels at ICSI with the Companies Act, 2013 becoming a reality in August 2013.

I hope that the re-learning has started and all of you are fully geared up to face the challenges and opportunities that await us. With 98 sections getting notified, the transition has really begun. I hope you are all are busy understanding the Rules and e-forms that are open for public comments. ICSI-WIRC earnestly looks forward to receive your suggestions on Rules and e-forms, which may be sent to ICSI-WIRC forthwith, so that your suggestions can be forwarded to ICSI-HO.

ICSI-WIRC has been pro-actively working on the Rules and e-forms, and group of experts from industry and practice is already on job. In the meanwhile various programs were held by ICSI-WIRC and its Chapters.

During August-September 2013, Students’ Conference and Goa Conclave for members were held in Goa between 30th August 2013 and 1st September 2013. Hon’ble Chief Minister of Goa, Mr. Manohar Parikar graced the Valedictory Session, when CS Ananthasubramanian, President-ICSI and CS B. Narasimhan, Council members were also present on the occasion. Aurangabad Chapter hosted Two-Days State Conference on Corporate Scenario – Emerging Trends” on 7th and 8th September 2013, which was inaugurated by Mr. Rishikumar Bagla, Managing Director, Aurangabad Electricals Ltd.

The ICSI-WIRC published “Transfer Pricing” at State Conference at Aurangabad. I am thankful to CS A. Sekhar for authoring the publication. I also thank CS Prakash Pandya, for his continuous and untiring efforts in bringing out the publications.

Before concluding, I again appeal the members to join COMPANY SECRETARIES BENEVOLENT FUND, if they have yet not joined.

With Warm Regards,

CS Hitesh Buch

Chairman

ICSI-WIRC

19th September 2013

Editorial Board

Photo Feature

Companies Bill 2012- An introspection

Background:

Background:

SEBI Committee on Disclosures and Accounting Standards (SCODA) reviewed the Clause- 41 of the Equity Listing Agreement (LA) as part of review of the extant norms relating to disclosure requirements. The Discussion paper placed on SEBI’s website on 21st August, 2013 solicits public comments on or before September 13, 2013 by way of email to revisedclause41@sebi.gov.in or by post addressing SEBI’s Chief General Manager, Mr. V.S. Sundaresan

Existing Clause 41 of the LA specifies provisions with respect to the following along with Annexures:

I) Preparation and Submission of Financial Results

II) Manner of approval and authentication of the financial results

III) Intimation of Board Meeting

IV) Other requirements as to financial results

V) Formats

VI) Publication of financial results in newspapers

VII) Interpretation

SEBI is considering revising the existing clause 41 to ensure the following:

a) non-manufacturing companies need not make disclosure in line with that of manufacturing companies;

b) the inconsistencies and ambiguities in interpretation of the policy intent that arose as a result of piece-meal updation of sub-clauses is addressed;

c) various representations received requesting for modifications are looked into;

d) adoption of Revised Schedule-VI of the Companies Act, 1956 and revision in Accounting/ Auditing Standards, etc are reflected in revised clause.

e) to improve the disclosure standards and reduce the compliance cost/time for the listed companies

f) to make the disclosure requirements consistent with requirements of Companies Bill, 2012

Highlight of new requirements:

• Format for Finance Companies

o Suitably modified and can now be used by both banking companies & other finance companies

• Mandatory Disclosure of half yearly consolidated financial statements

o In case of variation of 20% or more in the revenue / total assets / total liabilities / profits (loss) in the consolidated financial results vis-à-vis the corresponding amounts in the standalone financial results as per the last annual audited financial statements

• Inclusion of reviewed/ audited results of foreign subsidiaries/ joint ventures in the consolidated results

o Such that together with the reviewed/ audited results of all Indian subsidiaries/ joint venture, constitutes atleast 80% of the consolidated turnover/ net worth/ profit (loss)

• Book Value of equity shares to be mandatorily disclosed in every six months

• Amounts in financial statements to be mandatorily presented in Rs. Cr. with 2 decimals.

• Cashflow statements to be mandatorily submitted every six months in addition to the statement of assets and liabilities.

• Details of discontinued operations to be mandatorily disclosed as a part of notes to the financial results.

• Option to form a Committee for approval of financial results in the absence of Managing Director

o Committee to comprise of atleast one third of the directors and to include atleast one whole-time director and one independent director.

Detailed Comparison of Existing & Revised Clause 41of LA:

For our other write-ups and analysis on SEBI related issues, you can please click:

http://www.india-financing.com/sebi.html

For our other write-ups on issues related to corporate laws, you can please click:

http://www.india-financing.com/staff-publications-corporate-law.html

CSR in Companies Bill, 2013

The most awaited companies bill, was passed by Lok Sabha on 18th December, 2012 and by Rajya Sabha on 8th August, 2013. Now it awaits the assent of President before it becomes the Act. Many new changes have been brought through this bill to plug the loopholes in current act by more stricter provisions and more disclosures, to provide the stimulus for growth opportunities to business community, to help the small entrepreneurs by setting up One Person Company. However one thing that is much highlighted in this new bill is the concept of legislating CSR-Corporate Social Responsibility. In speech at Rajya Sabha and at Lok Sabha this was the topic that was most spoken about by the Minister of Corporate Affairs Shri Sachin Pilot. So what is this CSR and what would be its implication in corporate world is will be seen in time to come.

The most awaited companies bill, was passed by Lok Sabha on 18th December, 2012 and by Rajya Sabha on 8th August, 2013. Now it awaits the assent of President before it becomes the Act. Many new changes have been brought through this bill to plug the loopholes in current act by more stricter provisions and more disclosures, to provide the stimulus for growth opportunities to business community, to help the small entrepreneurs by setting up One Person Company. However one thing that is much highlighted in this new bill is the concept of legislating CSR-Corporate Social Responsibility. In speech at Rajya Sabha and at Lok Sabha this was the topic that was most spoken about by the Minister of Corporate Affairs Shri Sachin Pilot. So what is this CSR and what would be its implication in corporate world is will be seen in time to come.

Provision of CSR under the Bill.

The provision of CSR wil be applicable to following companies having:

a. networth of Rs. 500 crore or more; or

b. turnover of Rs. 1000 crore or more; or

c. net profit of Rs. 5 crore or more.

The provisions require:

• Formation of CSR committee consisting of atleast 3 directors, one of them being independent director.

• Formulate and recommend to the Board the CSR policy and the activity to be undertaken by the company as per Schedule VII.

• Recommend the expenditure to be incurred for the said activity.

• Spend atleast 2% of average net profits of company made during immediately preceding 3 financial years in pursuance of Corporate Social Responsibility Policy

• Monitor the CSR policy from time to time.

The preference has to be given to the local areas and areas around where it operates for spending the amount. Further if the company is unable or fails to spend the said amount, then the Board will have to specify the reasons for the same. The CSR activity carried out by the company will have to be displayed on the website of the company and in the Board Report. The Bill does not specify any penalty for non compliance of same.

Government Intention behind the concept of CSR.

The government has tried to introduce this concept with all positive approach. If one observes the view of the minister on the CSR provision, it makes an attempt to show that government does not wish to regulate the CSR activities of the company but to provide loose guidelines for the same. The idea not being to operate as Inspector Raj or requirement of any Government Certification, but is left to the conscience of the company to deploy the funds for the betterment of the society. There are large number of corporates undertaking CSR activities and the provision in the bill will only help corporates create goodwill and give a structured format to tell the shareholders about the CSR activities. The CSR is not a tax or a levy which the company has to give the government. It is only an urge to the companies to spend the amount through the agencies they are familiar with, for the issues they wish to address. As the corporates earn huge amount of profits, it does sometimes create a sense of exploitation among the community in which operate. However CSR gives an opportunity to the corporates to give back to the society and also fulfil its responsibility from where it has received a lot.

How is CSR viewed by the Corporate Community:

The concept of CSR is not a new concept, however legislating the same is surely a new one. Fulfilment of one's social responsibility is to be done voluntarily and not through compulsion or legislation. The concept not being new is said because there are many corporates who have given back to the society and have been doing so since many years even before the concept of Corporate Social Responsibility emerged or even existed. A company which wants to give back to the society does not need any kind of legislation. Also even though it is not a tax levied by government to be given to the government, yet it is a mandatory amount to be shelled out by the corporates. It can be said that a levy given a different name. Many questions have been raised through legislation of CSR like:

How is it different from levy or tax or cess?

Isn't the corporates giving back to the society by paying huge amount of education cess?

Will not the funds be misappropriated under the name of CSR as there being no check for the spending of same?

Will not there be political interference for diverting the funds of CSR for a particular cause or wont there be political pressure cannot be said.

Isn't the government shying away from fulfilling its duty of giving the facilities to the society by asking the corporates to do the same?

These are some of the question which do cause apprehension about the success of this concept, but which can be best answered when the CSR comes into practice. Although the concept has been introduced by taking into consideration all positive aspects, however the eyes cannot be closed to its negative impact also.

Conclusion.

The idea behind mandating the CSR is very noble by providing a platform to the corporates to give back to the society from where they operate and also enable the people to take the fruits of the of the corporate. However this can become successful only if Board fulfils its responsibility diligently, the shareholders monitor or is aware of the activities undertaken by the corporates and question if they find that the funds are not utilised in the manner they should be as there will surely be full disclosure about the same. It is a collective duty of everyone to make CSR a success. But it is yet to be seen whether this new concept does help to create a better society or will emerge as another biggest corporate blunder.

Areas where company secretaries can step in

INTRODUCTION:

INTRODUCTION:

It is rightly said by someone that “You create your own opportunities.”

It is observed that Company Secretaries are less agile at Job as well as at practice whenever something new is approached. Majority of us restrict ourselves to Company Law, Listing Agreement and ROC work and if we happen to assign new areas of work, we think “it’s not in our domain, how can we do this!!”

Don’t you think we should explore our Brand ‘The Company Secretary’ over and above the normal monotonous compliance work? Here, we have thrown light on few areas where Company Secretary can step in:

BANKING SERVICES

• The Capital Market division of Banks deal with various transactions like IPO, Rights Issue, Delisting of shares, Takeover etc., as “Bankers to the issue”.

• The Capital Market division of Banks deal with various transactions like IPO, Rights Issue, Delisting of shares, Takeover etc., as “Bankers to the issue”.

• Although majority of banks appoint legal advisors or have their own legal department assisting them for such assignments but there is always a comfort if the concerned person from Capital Market Division itself is a CS. It will be beneficial as the CS can resolve the investor grievances /queries more comfortably and they do not have to approach legal advisor /legal department for every small matters.

INVESTMENT BANKING

• It is one of the creamy area where Chartered Accountants and MBAs have established themselves but Company Secretaries are still finding it hard to manage.

• Investment Banker assists an organization in raising capital and restructuring process. Due diligence is the basic for initiation of any kind of structuring process. CS having knowledge of corporate compliances, listing compliances, restructuring compliances and other legal formalities can play a very important role. CS with the excellent skill of analyzing the balance sheet is preferred to be part of Investment Banking Company.

STOCK BROKERS & SUB-BROKERS

• Stock Brokers have to comply with SEBI (Stock-Brokers and Sub-Brokers) Regulations, 1992.

• In accordance with Regulation 18A of the SEBI (Stock-brokers and Sub-brokers) Regulations, 1992, every trading member has to appoint a compliance officer who shall be responsible for monitoring the compliance of the trading members in respect of the Act, Rules, Regulations, notifications, guidelines, instructions, etc. issued by SEBI or the Central Government and for redressal of investor’s grievances.

• The Stock Brokers registered with SEBI have to deal with number of compliances on regular basis. This includes the limit of credit amount to be allowed to clients for trading alongwith the regular updation and reporting to stock exchange, appointment of and change in designated directors, intimation of change in control, Change in name and all other Compliances which are laid down in Rules, Regulations and Byelaws of the Exchange and their Clearing Corporation.

• Further Stock Brokers are involved as “Trading Members” in the securities market transactions like IPO, Right Issue and Delisting. CS is the most suitable person to deal with it conveniently.

• Considering more stringent rules & regulations constantly introduced by SEBI, Compliance Officer of the Stock Broker/Sub-broker is the emerging field for the Company Secretaries.

STOCK EXCHANGES

Listing Department –

• There are various applications made by the Companies to the listing department of the Stock Exchange for getting their shares listed. Stock Exchange sets a procedure for forwarding the application in accordance with the ICDR Regulations of SEBI. The job of verifying the application in accordance with ICDR Regulations and coordination with the Compliance Officer of the company for any queries and doubts can be dealt easily by a CS.

• Pursuant to listing agreement there are various quarterly, annual and incidental compliances for corporate. These compliances are carried out by CS of the company periodically. However, a person with equivalent knowledge of Company law and listing agreement is required for verification of such compliance related documents at the Stock Exchange. CS can not only improve the quality of verification but also understand the basis of the documents filed with Stock Exchange.

Investor Grievance Department –

• All the Stock Exchanges have established separate cell for resolving Investor Grievances which is known as Investor Grievance Cell (IGC).Due to various initiatives taken by SEBI, Investors are becoming more alert and approach Stock Exchanges frequently with queries .

• Having in depth knowledge of Company Law and various applicable rules, regulations and bye laws, CS can be deputed in IGC of Stock Exchanges and can apply his/her knowledge in resolution of grievances.

Legal Department:

• Legal Department at stock Exchanges involves the work relating to managing various litigations, drafting replies with respect to various cases, facilitate the amendments to the Rules, Byelaws and Regulations of Stock Exchange, drafting and preparing legal notices, agreements, internal department queries and letters, provide advice on non-litigation matters to various departments etc.

• The CS with LLB is the most suitable for the aforementioned functions of the Legal Department of Stock Exchanges. Nowadays many companies prefer such dual degree combination in order to have single control over compliance and legal department.

Inspection Department-

• Inspection Department of the Stock Exchanges is responsible for conducting Inspections of Trading Member and Clearing Member at regular intervals or in case of any suspect of the fraud.

• They have to ensure that whether there is any violation of Prevention of Money Laundering Act any other rules, regulation and bye laws of Stock Exchanges. If they find any non- compliance, they ask the respective authorized person to rectify the same and impose the penalty also.

• CS with good analytical skill and Financial Knowledge would have an edge to be part inspection department.

Similarly other Regulatory bodies like Ministry of Corporate Affairs, Securities Exchange Board of India, and Competition Commission of India do have such similar areas to be part of.

LEGAL ADVISOR

• There are various legal consultants which provide consulting services to the corporate for legal formalities which company secretary can get involve into. CS is very good at Corporate Compliances which is an advantage and such knowledge will be the base to provide legal consultancy. For example there are end numbers of legal opinions and consultancy provided on section 397 & 399 of Companies Act, 1956, which the CS should be most comfortable to handle as the base of it is derived from Companies Act.

PROFESSORS

• This is the new flourishing area with high demand for qualified CS who is good at public speaking and can make people understand well. The Institute of Company Secretaries of India has been trying hard since past few years to enroll more and more students to this profession. As a result a large chunk of students has enrolled themselves creating high demand for coaching classes.

• CS who are ready to take teaching as their area of practice can jump into this area as the future outlook is undoubtedly much more greener than the current state. The remuneration offered to such professionals is generally per lecture, which runs in thousands.

FEMA CONSULTANCY

• The complicated areas of Foreign Exchange Management Act (FEMA) are worth exploring. Growth in MNCs and Foreign Investors has brought this field in great demand.

• Some of the transactions with complicated schemes include External Commercial Borrowing, Transfer of shares, between resident & non-resident entity, Allotment of shares to non- resident, Setting up Joint Venture (JV) / Partnership by NRI'S or persons of Indian origin, Approval and issues relating to Foreign Direct Investment, Opening branch office/liaison/project in India and many other aspects.

• There is no defined criterion to be part of this field and the two preferred streams are CA and CS.

TAX CONSULTANT

• Many of us have phobia of Taxation and accounting. However, this is the stream where we need to open up our eyes and see the endless opportunities.

• Tax consultancy encompasses Direct as well as Indirect Tax. Direct tax includes Income Tax services, Fringe Benefit Tax, transfer pricing and many other areas. Further, each area has various sub-divisions. Indirect Tax is vast area of practice which contains Value Added Tax, Service Tax, Excise, Custom etc.

• However, for practicing as Tax Consultant, we must strive hard to shape our skill and knowledge by keeping ourselves constantly updated by various amendments, case laws. It involves deep knowledge of all applicable laws.

• Undoubtedly this field is practiced and preferred for CAs but it’s not too hard to be part of.

FORMATION AND REGISTRATION SERVICES

• Making available single window services to the clients by providing services like registration services which comprise registration with Income Tax Authority(PAN, TAN), Service Tax Authority, VAT authority, Excise & Custom Authority, Custom Authority, obtaining of IEC code, Labour Law related authority such as Employee State Insure Corporation(ESIC), Employment Exchange, registration under Factories Act, Shops & Establishment etc, registration of Company or Unit as Special Economic Zone(SEZ), Software Technology Park of India, registration/clearances under various environment authorities such as Pollution Control Board etc., registration for various Intellectual property rights (Trademark, copyright, patent) alongwith the formation of the entity.

SOX ADVISORY SERVICES:-

• The Companies registered with SEC (Securities Exchange Commission) have to comply with Sarbanes Oxley Act known by SOX.

• The CS in employment can look after SOX compliances and CS in practice can offer SOX advisory services such as establishing SOX compliance life cycle, document and review, control testing, continuous monitoring and review and ongoing SOX compliances.

KNOWLEDGE PROCESS OUTSOURCING(KPO):

• One more booming area for a CS is KPOs.

• This is the colossal area which includes Market Analysis, Equity Research, Investment Analysis, Cost Management, Internal Control, Strategy & Risk Management, Dispute Resolution, Compliance Management, Documents Management, Inventory Management, Physical Asset verification, Employee Training etc.

CORPORATE FINANCE:-

• The CS in employment can also handle corporate finance which involves many approvals and documentations. The CS can act as intermediary between Banks and the Companies for Corporate Finance.

• The CS in practice can provide advisory services to the clients for the Corporate Finance.

CORPORATE GOVERNANCE ADVISOR:

• Nowadays, Companies are turning towards adhering best Corporate Governance practices to gain the trust & confidence of the stakeholders and to establish in the global market.

• CS in employment can take initiative and set up policies for high standard corporate governance practices.

• CS in practice can provide Corporate Governance advisory services which includes Corporate Governance rating, Corporate Social Responsibility, assessment of effectiveness of Board and Audit Committee, Communication, Integrity & ethics, external relationship, Risk management and better Internal control system etc.

HUMAN RESOURCE & LABOUR LAWS RELATED CONSULTANCY:

• Managing Human Resource is a powerful and important job to lead the Company. Company Secretaries should take an opportunity for HR related work such as manpower planning, recruitment, selection, training and development, employee motivation, compliance with the various labour laws etc. There are ample of opportunities in HR Consultancy.

INTELLECTUAL PROPERTY RIGHTS CONSULTANT:

• The Company Secretaries in practice can provide Intellectual Property Rights (IPR) related services such as acquiring, maintaining, transferring and litigating IPR, patent validity, trademark applications, work relating to domestic & international utility patent, non-disclosure and non-competition agreements etc.

To conclude, it is rightly said by Dale Carnegie “The man who grasps an opportunity as it is paraded before him, nine times out of ten makes a success, but the man who makes his own opportunities is, barring an accident, a sure-fire success”

Therefore, let us strive hard to expand and explore our Brand ‘The Company Secretary’ by creating opportunities and preparing ourselves for the same rather than waiting for the opportunities to occur and be prepared.

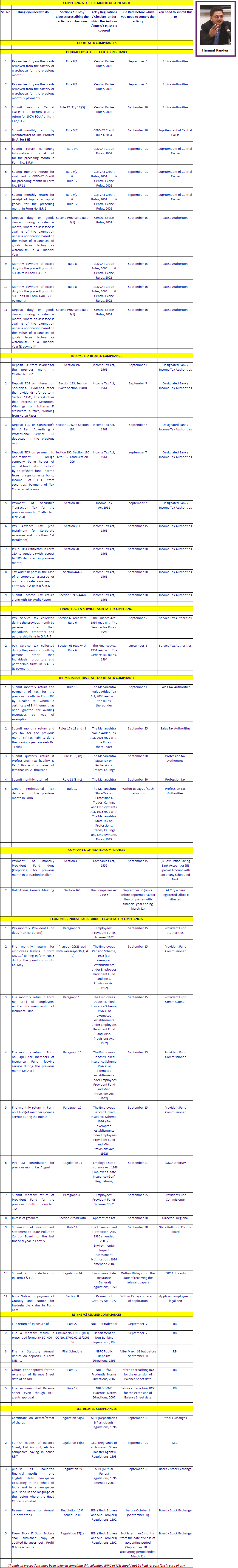

Comparison of Companies Act, 1956 and New Companies Act

The great Greek philosopher Heraclitus has said very well that ‘Change is the only thing that is constant in this world’.

Things never remain the same and keep on changing. One needs to accept those along with the changing situations. The

new Companies Act is one of the examples of such a major change in the Indian corporate environment.

The great Greek philosopher Heraclitus has said very well that ‘Change is the only thing that is constant in this world’.

Things never remain the same and keep on changing. One needs to accept those along with the changing situations. The

new Companies Act is one of the examples of such a major change in the Indian corporate environment.

The much awaited Companies Bill has been passed by both the houses of parliament i.e. Lok sabha and Rajya sabha on December 18, 2012 and August 08, 2013 respectively, thus replacing more than fifty years old Companies Act. Further, the President of India has also given his assent. During the course of time, the new companies rules would be drafted for public comments and the same would be notified in the official gazette resulting in the new Companies Act to be effective.

Once the new Companies Act gets effective, all the Indian as well as foreign Companies registered under Companies Act will have to comply with the updated provisions of this new Companies Act. Though this Act will create new and improved regulatory environment in India, the Company’s management and professionals need to prepare themselves to adapt to the changing environment. For this purpose it is very much important to highlight the differences between the existing and the new Companies Act and the watershed period allowed for the existing Companies to adapt to the requisite changes once the Act comes into force.

Here are some of the points which shed light on the major differences in provisions of existing Companies Act, 1956 and the new Companies Act:

It is true, that it would be a rework for all the stakeholders, management and professionals to check for all the provisions of the new Companies Act. However, keeping in mind that ‘change is not a threat but an opportunity’, one needs to take it in a positive way and strive to build a better corporate environment by means of improved level of transparency, better governance, enhanced accountability, inculcating self-compliance and making corporates more socially responsible.

Alvin Toffler has very aptly quoted “The illiterate of the 21st century will not be those who cannot read and write, but those who cannot learn, unlearn, and relearn”; thus this change is an opportunistic window for professionals to relearn.

How the World’s reserve currency value is determined, and what decides putting a price on oil?

Introduction

Introduction

Company secretaries, foreign currency managers, commodity traders, bankers, chief risk and investment officers, CFOs and Board members are often concerned with how the value of the World’s reserve currency U. S. Dollar is determined. They are also asked to explain the global phenomenon as to what makes the oil prices so high, given the fact that oil is traded in U. S. Dollars. This article has endeavored toanalyse markets pandemonium that impacts almost all businesses, consumers and global economy, and provides company secretaries with ways for value creation in efficient deployment of capital in a given market and financial risk environment.

1) Dollar Is Losing Value over the Long-term –five ways

No matter how you measure it, the dollar is losing value over the long-term. Here's why:

(i)U.S. debt is more than $16 trillion. Foreign holders of this debt are concerned that the U.S. will let the dollar value decline so the relative value of its debt is less –a higher denominator USD rate amount when applied to debt denominated in say euro will give a lower debt amount.

(ii)Large debt could force the U.S. to raise taxes to pay it off, which would sloweconomic growth.

(iii)As more countries join or trade with the European Union, demand for the euroincreases.

(iv) Foreign investors are diversifying their portfolios with more non-dollar denominated assets.

(v) As the dollarlosesvalue, investors are less likely to hold assets in dollars as they wait for the declineto stop.

2) Methods to measure dollar value –three methods

U. S. dollar's value can be measured by three methods:

(i)Exchange rates,

(ii)Treasury notes,and

(iii)Foreign exchange reserves (the amount of dollars held by foreign countries).

These three measurements usually are in sync with each other.

3) Dollar Value Is Measured by Exchange Rates

U.S. dollar is most easily measured by its exchange rate, which compares its value to other currencies. Currency exchange rates allow you to determine how much of one currency you can exchange for another.A currency's forex value depends on a lot of factors, including central bank interest rates, the country's debt levels, and the strength of its economy. Most countries allow their currencies to be determined by the forex market. This is known as a flexible exchange rate.

Example of dollar exchange rate with euro

1) 2012 - dollar lost value against the euro, as it appeared the eurozone crisis was being managed. By the end of 2012, the euro was worth $1.3186.

2) 2011 - The dollar's value against the euro fell10%, and then regained ground. As of December 30, 2011, the euro was worth $1.2973.

3) 2010 - The Greece debt crisis strengthened the dollar. By year end, the euro was only worth $1.32.

4) 2009 - The dollar fell20% thanks to debt fears. By December, the euro was worth $1.43.

5) 2008 - The dollar strengthened22% as businesses hoarded dollars during the global financial crisis. By year end, the euro was worth $1.39.

6) 2002-2007 - The dollar fell40% as the U.S. debt grew 60%. In 2002, a euro was worth $.87 v. $1.44 by December 2007. (source: Federal Reserve rates).

4) Dollar's Value Is Measured by Treasury Notes

Dollar's value is usually in sync with demand for U.S. Treasury notes. The Treasury Department sells notes for a fixed interest rate and face value. Investors bid at a Treasury auction for more or less than the face value, and can resell them on a secondary market.

High demand means investors pay more than face value, and accept a loweryield.

Low demand means investors pay less than face value and receive a higheryield.

That's why a highyield means lowdollardemand -- until the yield goes high enough to trigger renewed dollar demand.

(i)Example: Yield rates on U. S. Treasury Notes

1) 2012 - The dollar strengthened significantly, as the 10-yearTreasury note yield fell in June to 1,443 -- a 200-year low. By the end of the year, the yield had risen to 1.78%. (Remember, low yields mean a strong demand for Treasuries and dollars).

2) 2011 - The dollar weakened in early spring but rebounded by the end of the year. The 10-year Treasury note yield was 3.36% in January, rose to 3.75% in February, then plummeted to 1.89% by December 30.

3) 2010 - The dollar strengthened, as the yield fell from 3.85% to 2.41% (January 1-October 10). It then weakened due to inflation fears from the Fed's QE2 strategy.

4) 2009 - The dollar fell as the yield rose from 2.15% to 3.28%.

5) 2008 - The yield dropped from 3.57% to 2.93% (April 2008-March 2009), as the dollar rose.

6) Prior to April 2008, the yield stayed in a range of 3.91%-4.23%, indicating a stable dollar demand as a world currency.(Source: U. S. Daily Treasury Yield Curve Rates).

(ii) Dollar value impacted by huge debt burden

Value of the dollar, whether measured by exchange rates or Treasury yields, is undermined by the $16 trillion U.S. debt.

During the recession, investors wanted a safe investment, which strengthened the dollar. When global confidence picked up, the dollar resumed its downward trend and Treasury yields rose as long as the Federal government auctioned more notes to fund the debt.

Fed's quantitative easing plan sopped up some of the excess debt by monetizing it. The dollar benefited from a temporary flight to safety, as investorswere worried about the outcome of the 2012U. S. Presidential campaign and the fiscal cliff.

5) Value of the Dollar as Measured by Foreign Currency Reserves

Dollar is held by foreign governments who have an excess of dollars, which they hold in foreign currency reserves. Excess happens when countries, such as Japan and China, exportmore than they import. As the dollar declines, the value of their reserves also declines. As a result, they are less willing to hold dollars in reserve.

They diversify into other currencies, such as the euro or even the Chinese Yuan. This reducesdemand for the dollar, putting further downward pressure on its value.

(i)Dollar reserves are declining in relative terms

As of Q3 2012 (most recent report), there was a record $3.716 trillion in foreign government reserves held in dollars. This represents 61.8% of total measurable reserves, down from Q3 2008, when dollars comprised 67% of reserves.

Since the percentage of dollars is slowly declining, this means that foreign governments are slowly moving their currency reserves out of dollars.

In fact, the value of euros held in reservesincreased from $393 billion to $1.45 trillion during this same time period, despite the eurozone crisis. Despite this growth, this is still less than half the amount held in dollars. (Source: IMF).

(ii) How the Value of the Dollar Affects the U.S. & global economy

When the dollar declines, it makes American-madegoodscheaper and morecompetitive when compared to foreign producedgoods. This helps increase U.S. exports, boosting economic growth.

However, it also leads to higheroil prices in the summer, since oil is priced in dollars.

Whenever the dollardeclines, oil producing countries raise the price of oil to maintain profit margins in their local currency.

(iii) Example of how the dollar value changes affect the U. S. economy

1) For example, the dollar is worth 3.75Saudi riyals. Let's say a barrel of oil is worth $100, which makes it worth 375Saudi riyals. If the dollar declines20% against the euro, two things happen.

2) First, the value of a barrel of oil has declined 20% to the Saudis.

3) Second, the value of the riyal, which is fixed to the dollar, has also declined20% against the euro.

4) To purchase French pastries, the Saudis must now pay more than they did before the dollar declined.

5) To avoid this, the Saudis raise the price of oil, which they do by threatening to limit supply. You notice this when you pay more for gas each week.

6) What decides putting a price onoil? –oil price volatility analytics

If the global economy is healthier than in 2008, why wouldn't oil prices be higher?

That's because there are many more outlets for investment funds. In 2008, the global markets were so risky and uncertain, investors turned from stocks, bonds and even housing to the U.S. dollar, gold and oil.

In 2012, despite uncertainty around the eurozone crisis, investors have many more options. The stock market is rising, the bond market is less risky, and even housing is seen as less dismal. Although the global market is still in slow growth mode, it is stabilizing, and that means oil prices shouldn't break the peak hit in 2008.

7) Reasons for high oil prices in 2012 onwards

Oil prices started rising much sooner in 2012 than they did in 2011. The price for WTI crude oil broke above $100 a barrel on February 13, 2012 two weeks earlier than in 2011.Rising oil prices drove gas prices above $3.50 a gallon that same week. Gas prices had already breached $3.50 a gallon on the East and West coasts in January 2012.

By March 2012, Brent Crude Oil (which is more expensive than WTI) peaked at $125 a barrel. It settled down to $95 a barrel in June, but rose $113.36 by August 2012. Normally, oil prices drop in the Fall and Winter. However, commodities futures traders were bidding up oil prices to offset what the Fed's expansive monetary policy. Traders were betting the dollar would drop, which drives up oil prices. They were wrong about the dollar, but oil prices rose despite lowerdemand.

8) Oil prices driven by commodities markets

People were concerned because gas and oil prices rose earlier than in the past. However, less and less of oil prices are due to supply and demand. More and more of it is based on the expectations of commodities markets. Commodities trading drove up oil prices.

Why? Although the EIA pinned part of the blame on volatility in Venezuela and Nigeria, it warned of an influx of investment money into commodities markets.

Investors were stampeding out of the fallingreal estate and stock markets. Instead, they diverted their funds to oil futures

This sudden surge drove up oil prices, creating a speculative bubble. (Source: EIA –short term energy outlook).This bubble soon spread to othercommodities. Investor funds swamped wheat, gold and other related futures markets.

9) Trading of Oil futures contracts by traders

Commodities traders look at projected supply and demand to help them decide how high to bid on oil futures prices. However, if all traders think the price of oil will be high, they can create a self-fulfilling prophecy by bidding up oil prices. This can create high oil prices even when there is plenty of supply on hand. Once this starts, other investors will bid on oil prices just like any other commodity, such as gold, creating an asset bubble.

(i)What is an oil futures contract?

Oil futures contract is an agreement to buy or sell a specified amount of barrels of oil at a specifiedprice on a specificdate. Futures contracts are executed on the floor of a commodity exchange by traders who are registered with the exchange or with the Commodities Futures Trading Commission.

Although these contracts are binding and based on realcommodities, speculativeinvestorstrade them on a market with no intention of actually purchasing or delivering any products.

Savvy investors can take advantage of changing commodities prices by trading futures contracts. You can make a lot of money, but you could also lose big; you could call it legalized gambling.

(ii) Purpose of futures contracts and use by oil producers

Writers create contracts in order to lock in prices in case of fluctuation. For example, if you produceoil and you think prices will go down (from $100 –current market price to $97 -your price in future), you can write contracts to lock in your prices ($97) now,to hedge against risk of fallingoil prices beyond $97; So, if future price goes down to $95, you will gain $2 a barrelon contracted quantity. If future price is $98, you will lose $1.

Similarly, if you believe that prices will go up (from $100 to $103), you'll buy contracts that lock in your prices ($103) now; if future price goes up only to $102, you will lose$1 a barrel. If future price is $104, you will gain$1.

Futures contracts are often used by pairs of business professionals to hedge their own bets.

(iii) Use of oil futures by speculative traders

Traders who aren't interested in actual products will buy and sell these contracts in order to benefit from changingprices.

If you think that prices will go up ($82), you'll buy the futures contract to deliver goods at $80 a barrel, and then sell them to someone else(at prevailing oil price $82 on date of sale of the contract) before the due date –you gain $2.

If you buy the same position at $80 but the price begins to decline ($77) before the contractdue date, you can sell the contracts to someone elsewho still thinks that prices will rise beyond $77 or that they'll hold steady for a profit. –you lose $3.

(iv) Risk for investors (speculative traders)

Major risk for investors is that oil prices will move in the opposite direction of yourposition (oil producer or another speculative trader or actual user –in short, commodities trader).

You (investors or traders) must get out of the position before the due date, or you'll end up with a lot of oil at your doorstep that will cost you a lot of money.

If necessary, you'll have to sell at a loss ($2, actual oil price in future being at $78) to close out your position before the due date of the contract–contract price $80.

Both parties of a "futures contract" must fulfill the contract on the settlement date.

(v) Tip –what should be the price direction to buy or sell a futures

If you think the price of oil will rise (from $80 to $84), buylow-priced ($81-$83) oil contracts -you will gain $1-$3; if oil price will fall (from $80 to $76), buyhigh-priced ($77-$79) oil contracts –you will gain $1-$3.

Your pricebet should be in the opposite direction to future market oil prices,to enable you to gain either or contractdelivery on due date or on getting out of theContract position before its due date.

10) All-Time High Was $145 a Barrel

Oil prices hit an all-time high of $145 a barrel in July 2008. This drove gas prices to $4.00 a gallon.

Most news sources blamed this on surging demand from China and India, combined with decreasingsupply from Nigeria and Iraq oil fields.

However, even then this wasn't logical, since the U. S. economy was already in a recession.

11) Supply and Demand Are Not Alone in Driving Up Oil Prices –price rise in recession too

Price of oil is driven by much, much more than supply and demand. This was proven in 2008. Thanks to the recession, global demand in 2008 was actually down and global supply was up. Prices rose, nevertheless.

Oil consumptiondecreased from 86.66 million barrels per day (bpd) in the fourth quarter 2007 to 85.73 million bpd in the first quarter of 2008. At the same time, supplyincreased from 85.49 to 86.17million bpd.According to the laws of supply and demand, prices should have decreased. Instead, they increased almost 25% in that time - from $87.79 to $110.21 a barrel. (Source: U. S. Energy Information Administration -EIA).

12) Oil prices are raised to maintain profit margins

High oil prices are also driven by a decline in the dollar. Most oil contracts around the world are traded in dollars. As a result, oil-exporting countries usually peg their currency to the dollar. When the dollardeclines, so do their oil revenues, but their costsgo up.

Therefore, OPEC must raise the price of oil to

1) Maintain its profit margins and

2) Keep costs of importedgoods constant. (Source: USA Today, Oil Briefly Spurts Near $104 per Barrel, March 3, 2008).

13) Risk of alternative fuel source drops oil prices

However, OPEC doesn't want oil prices too high, or alternative fuel sources start to look good. OPEC has said its target price for oil is between $70 and $80 a barrel. In 2008, Saudi Arabia announced it would increasesupply. This was one reason prices started to drop.

14) Oil reserves, a monopoly in most countries –responsible for high prices

Oil reserves are a monopoly in most countries which have oil reserves. Prices remain high in a monopoly market structure.

Additionally, with a view to increase their negotiating powers of supplying and pricing, a few countries have joined hands together, like the OPEC in 1960. These exporters have done so to keep the price of oil fairly high. Since oil is a non-renewable resource, when it's gone these exporters have nothing left to sell. Therefore, they want to get the highest profit possible while it lasts. They can only do this if they collude, rather than compete.

The 12 OPEC members hold 80% of the world's proven reserves. The biggest importers are the U.S., the European Union and China. There is 1.532 trillion barrels of oil in the world as of January 2012. That's enough to last around another 50 years, since the world uses 84 million barrels per day. Reserve keeps fluctuating due to oil reserves growth.

15) World crises and oil prices -examples

(i)Oil energy is attributable to the massive economic advances in the 20th century and into the 21st. Oil accounts for 40% of the World energy-mix. Importance of oil was realized when in October 1973. OPEC nations stopped exporting oil to the U. S. and other western economies consequent to the Arab-Israel conflict in 1967. One of the long-term effects of the embargo was an economic recession throughout the world. Inflation remained above ten percent in U. S. and unemployment was at its record high. The era of economic growth, in effect since World War II, ended in 1973. Arabs began to ship oil to Western nations again, but this time at inflated prices. Speed limits and fuel economy stickers are a result of theGovernments’ efforts to preserve oil. Third World states discovered that their natural resources, on which they depended upon, specifically oil, could be used as a weapon in both political and economic situations. The rising oil prices continued to be a threat to not only America’s economy, but also that of the world. President Jimmy Carter would later call the oil situation in the 70’s "the moral equivalent of war." Never had the price of an essential commodity risen so quickly and dramatically.

(ii) Iran crisis–prices of oil and gasoline rose

This happened in January 2012, after inspectors found more proof that Iran was closer to building nuclear weapons capabilities. U.S. and European Union began financial sanctions.Iran situation remains a wild card for oil prices.Potential world crises in oil-producing countries can also dramatically increaseoil prices. That's usually because traders anticipate the crisis will limit supply.

(iii) World unrest–Arab Spring–Oil prices rose but declined later

World unrest also caused oil prices to rise in the spring of 2011. In March 2011, investors became concerned about unrest in Libya, Egypt and Tunisia in what became known as the Arab Spring. Oil prices rose above $100 a barrel in early March, reaching its peak of $113 a barrel in late April 2011.

(iv) Effect of Disasters on Oil Prices –natural

• Hurricane Katrina–Oil and gasoline prices rose

Natural and man-made disasters can drive up oil prices if they are dramatic enough. Hurricane Katrina caused oil prices to rise $3 a barrel, and gas prices to reach $5 a gallon in 2005. Katrina affected 19% of the nation's oil production. It came on the heels of Hurricane Rita. Between the two, 113 offshore oil and gas platforms were destroyed, and 457oil and gas pipelines were damaged.

• Mississippi River Flooding May 2011–Gasoline prices rose

Gas prices rose to $3.98 a gallon. Traders were concerned the flooding would damage oil refineries.

(v) Effect of Disasters on Oil Prices –man made

• Exxon-Valdez oil spill–Oil price did not rise

• BP oil spillin the Gulf of Mexico–Oil and gasoline prices barely rose

BP oil spill spewed more than 18 times the oil than did the Exxon Valdez. Yet, oil and gasprices barely budged as a result. Why?

For one thing, globaldemand was down thanks to a slow recovery from the 2008 financial crisis and recession. Second, even though 174million gallons of oil was spilled, it was over a long period of time, and it wasn't a large percentage of total oil used by the U.S. In fact, it was only about 9days’ worth of oil. U.S. consumed 6.99billion barrels in 2010, according to the U.S. Energy Information Administration. That's a little over 19million barrels per day.

16) World global oil demand weighs on U. S. forced budget cuts

price has fallen According to the IMF, the U.S. spending cuts could cost the world's biggest oil consumer about 0.5 percent of its economic growth, a factor that could weigh on global oil demand.U.S. crude has fallen around $8 per barrel over February 2013. Fall in oil prices is coincidental to forced budget cuts effective 1 March 2013.U.S. oil futures fell to their lowest level in 2013 on 4 March (below $90)in reaction to weak U. S. economic data, Europe’s malaise,slowinggrowth in China and indicators that oil markets are amply suppliedand is unlikely to reverse course without signs of world economy improving.

17) Crude oil grades as benchmark in oil pricing (oil markets)

Types of crude oil grades used as a benchmark in oil pricing are: (1) Brent crude from North Sea. (2) West Texas Intermediate (WTI) –benchmark for U. S. crude market- which is relatively low density, and sweet because of its low sulfur content. (3) Other important oil markets include the Dubai Crude, Oman Crude, and the OPEC Reference Basket.

18) Concluding comments

Business managers and professional leaders like company secretaries would find it satisfying to drive the businesses of their entities by developing expectations of (i) valuation of the U. S. Dollar and (ii) oil prices in various oil markets like Brent crude, WTI, OPEC, NYMEX, thus laying down a sound strategy for spending and investing the scarce resource of capital most effectively, profitably and prudently, in an environment that is fraught with high risks andvolatilityin global economy and markets.

(Sources have been quoted in the article)

Local Body Tax

This word had been on everyone’s mind since last month and there were a lot of rallies and agitation on the roads by traders against LBT. All the trade unions coming together to keep their shops closed for more than a week to create pressure on the government to eradicate LBT from Mumbai. Governments defense for LBT was it’s simply a replacement of Octroi and a new name i.e. Local Body Tax (LBT). Let us understand the intricacies of LBT in the article ahead.

This word had been on everyone’s mind since last month and there were a lot of rallies and agitation on the roads by traders against LBT. All the trade unions coming together to keep their shops closed for more than a week to create pressure on the government to eradicate LBT from Mumbai. Governments defense for LBT was it’s simply a replacement of Octroi and a new name i.e. Local Body Tax (LBT). Let us understand the intricacies of LBT in the article ahead.

Inception of LBT

As per sub section (1) of Section 152T of the Bombay Provincial Municipal Corporation Act, 1949; and of all other powers enabling it in that behalf, the Government of Maharashtra, made rules namely “Bombay Provincial Municipal Corporations (local body tax) Rules, 2010” and tried to levy LBT in all Corporations of Maharashtra. The concerned sections are sec. 152A to sec. 152 O in chapter XI–A and sec 152 P to sec 152 T in chapter XI-V. The Act is governed by Urban Development Department.

What is LBT?

It is a tax which can be collected by Corporations on the basis of books of accounts. Any goods which are brought into the Corporation area (import) from outside Corporation area for use, consumption or sale are liable for LBT; it’s a type of Self Assessment (SA) tax

So what are goods?

Goods can be defined anything which includes animals. It is a very wide definition with an intention to include anything and everything bought into one municipal limit from other municipal limits.

Who is an importer?

“Importer” means a person who brings or causes to be brought any goods into the limits of city from any place outside the area of the city for use, consumption or sale therein.

Who is a dealer?

“Dealer” means any person who weather for commission, remuneration or otherwise imports, buys or sells any goods in the city for the purpose of business or in connection with or incidental to his business and includes factor, broker, commission agent, auctioneer, Central & State Government, Society, Club and A.O.P all dealers registered under the MVAT Act etc.

Is there an exception?

Any individuals who imports goods for his exclusive consumption or use.

Who all are covered under LBT?

“Business” includes any trade, commerce, profession, consumption or manufacturer carried on with a motive to gain or profit and whether or not any gain or profit accrues and whether or not there is a volume, frequency, continuity or regularity in such trade. All of them are covered. Professionals like Doctors, Advocates, Chartered Accountants, Company Secretaries, service providers who import the goods for consumption or use in profession are also included. However, any individual who imports the goods for his exclusive consumption or use is not liable to pay LBT.

Rate of Tax?

Rates of LBT are given in Schedule A Sec. 99: Taxable goods and vary from corporation to corporation.

Schedule B, provides list of goods which are exempt from LBT Sec.152Q: Tax free goods. There is a reference of MVAT Act especially for notified goods

Registration under LBT?

Any one liable to pay LBT shall not carry on business as a dealer without possessing a valid certificate of Registration. There are 3 types of Registration

a. Importer:

The dealer who is an importer and whose turnover of sale or purchases of taxable goods during the year, equals or exceeds Rs. 5,000/- and the value of goods imported equals or exceeds Rs. 5,000/- and the turnover of Sales or Purchases equals or exceeds Rs. 1,00,000/-, then he is liable for registration under LBT Rules.

b. In any other case:

The dealer who is not an importer and whose turnover of purchases of taxable goods equals or exceeds Rs. 5,000/- and turnover of all his sale or purchases during such year equals or exceeds Rs. 1, 50,000/-.

c. Temporary Registration [Rule 3(2)]

If a dealer is carrying on a business in the city on a temporary basis, then he shall be liable for temporary registration under the Act & Rules, irrespective of turnover of Sales & Purchases mentioned in sub-rule (1) as above.

Liability for registration accrues even if the limits mentioned above are crossed in the immediately preceding year (when LBT is introduced). A dealer (Temporary Dealer) liable for registration has to make an application within 30 days from the notified day and for Temporary dealer is 15 days. The application has to be made in Form “A” alongwith the details of documents mentioned therein.

How to determine the value of LBT goods?

LBT is to be paid on value of import. Normally it will be considered as purchase price other direct related expenses. Commissioner is empowered to fix tariff values for goods specified in Schedule A to determine the fair market price of goods, if there are reasons to believe that sale price/ purchase price is less than the fair market value, in the specified different scenarios.

Liability of LBT on whom?

Where any goods on which LBT is leviable, are imported into the limit of the City by any person (not being a registered dealer) from any place outside of the City area and sold to a registered dealer, there shall be levied and collected LBT on such goods at the rate fixed by the Corporation, under the rules, from time to time, and such registered dealer shall be liable to pay the LBT so levied. Provided that no LBT on the same goods shall be levied if such purchasing dealer proves to the satisfaction of the Commissioner that the LBT has been paid earlier on the said goods to the Corporation.

Returns to be filed?

A registered dealer has to furnish a half yearly return for the first six months of a year in Form E-I and an annual return in Form E-II.

Registered dealer opting for composition has to furnish only an annual return in Form E-II.

Temporary dealer will have to file Form E-I on monthly basis.

Due dates of filing Returns?

15 days from the end of half year in case of half yearly return (Form E-I). 15 days from the end of the year in case of annual return (Form E-II). In case of a temporary dealer within 10 days from the last day of month. The Commissioner may also exempt any dealer from furnishing a return.

Records to be maintained by the dealer?

A dealer has to maintain account of the value of goods imported, purchased, consumed, used and sold as prescribed. However, only a purchase register in Form ‘D’ is prescribed by the rules, as follows: S. No. of bill/Cash memo, Name/ Address of Vendor / Commodity Purchase Value/ Processing Charges / LBT Payable to be chronologically maintained. The entries are to be recorded on the date of receipt in city. Following further details of purchase/imports are to be recorded in said purchase register:

What is Composition Scheme?

• A composition scheme of lump sum payment of LBT is provided for dealers having purchases up to Rs. 10 lakhs per year. It starts with nil tax up to turnover of purchases of Rs. 1 lakh and ends with Rs. 20 thousand for turnover between 9 to 10 lakhs. Dealer opting for composition will have to furnish a declaration in Form R to the Commissioner.

• Any builder or contractor who undertakes the work of construction within the Municipal limits shall get himself registered with the Corporation under LBT and shall have the option of either paying LBT on the value of the goods imported into the limits of the City for construction or use, or alternatively making the lump sum payment of LBT in accordance with the following norms-

a) For construction up to 4 floors (where the building is without lift) - Rs. 100 per sq. meter

b) For construction up to 7 floors(where the building is with lift) – Rs. 150 per sq. meter

c) For construction high rise building (above 7 floors) – Rs. 200 per sq. meter

• There is no mention of built up area or carpet area or super built up area for the above sq.meters. The contractor who opts for lump sum payment of tax may make the payment of LBT, in advance to the extent of 50% of such amount due, on applying for grant of commencement certificate for such construction.

• Any dealer or person undertaking any work within the area of Municipal Corporation shall have the option of either paying LBT on the value of goods imported into the limits of the City for undertaking such work or alternatively, paying the said tax on lump sum basis at 0.25% of their total amount of contract value.

Whether any invoice is required to be issued under LBT?

Invoice is required to be issued when a registered dealer sells goods to another registered dealer or a registered dealer sells any goods exceeding Rs. 10/- in value in any one transaction to any other person. Counterfoil to be preserved for 5 years

Penalty: Sum not exceeding double the amount that would have been payable, if the goods sold had been imported by selling dealer in the city.

Assessment under LBT?

LBT due from a registered dealer liable to pay tax shall be assessed separately for each period.

Assessment can be made in following cases:

• Failure to file return

• Commissioner not satisfied with correctness

• Completion of the return.

• Dealer has claimed refund.

• Applied for cancellation of R.C.

• Dealer is liable to pay LBT but remained unregistered.

• Directed to file returns

Appeals?

The appeals under this Act shall be heard and determined by the judge. If the demand notice is raised by any officer, the appeal shall lie to Deputy Commissioner and if demand notice is raised by Deputy Commissioner then appeal shall lie to the Commissioner. Appeal to be filed within 15 days from the date of demand notice. The appeal will be admitted only if disputed tax has been deposited by the appellant.

Holding the Annual General Meeting of a Company on a public Holiday - A Myth or a reality

Preamble

Preamble

Readers may wonder as to whether it is worthwhile to have a discussion on the above subject at this juncture , given the fact that the Companies Bill 2012 is now only awaiting presidential assent before it becomes an Enactment to substitute the antiquated Companies Act,1956 (hereinafter referred to as “The 1956 Act”)which has survived the trials and tribulations of India Inc for over five decades. Notwithstanding that the 1956 Act will soon become a piece of history, considering that the sub-ordinate legislation in the form of Rules which are necessary to make the Bill 2012 complementary have not yet been placed in the public domain ,we are of the view that the prospective date from which the new law will become enforceable is some distance away . Besides the provisions in the New Bill retain substantially the features in the 1956 Act where it comes to holding an Annual General Meeting. For these reasons, a discussion on the above subject against the milieu of the !956 Act is worth our while as it gives us some food for thought and scope for introspection.

The Substantive law

Section 166(2) of the1956 Act unequivocally asserts that every annual general Meeting of a company shall, inter alia, be called on a day which is not a public holiday. A plain reading of the above Provision suggests that there are three basic ingredients which have to be satisfied in the aggregate for an Annual General Meeting (AGM) to be validly held. These are as under:

• The Meeting should be called for a time during business hours.

• The day on which the Meeting is called shall not be a public holiday.

• The Meeting shall be held either at the Registered office of the Company or at some other place which is located within the city, town or village in which the Registered office is situated.

We would hasten to add that the first proviso under the above Sub-section empowers the Central Government to exempt any class of Companies from the rigours of this Sub-section subject to such conditions , as it may impose.

Our intention is not to provide a pedantic and insipid run down on the statutory provisions to the informed readers as this would be analogous to carrying coal to Newcastle. What we shall endeavour to do in this discussion is to look at some issues which crop up largely out of Departmental pronouncements in the form of circulars, clarifications, as also run through with a tooth comb the clauses (a) and (b) in the second proviso that follow Section 166(2) which offer considerable scope for debate.

Section 166 –A mandatory Provision

Before we widen the contours of our discussion, at the outset, let it be said that Section 166 is a mandatory provision and not a regulatory provision as clarified by the Department vide circular F No.34/1/75-CL-III dated nil. The section casts upon the directors a statutory duty to call an Annual General Meeting (AGM) of its members regardless of whether the Accounts of the Company which are to be adopted at this Meeting are ready or not . (Dalmia Cement (Bharat)Ltd vs Registrar of Companies (1953)23 Comp Cas 139(Mad).The Section applies in equal measure to both Public and Private Companies. There is no immunity from compliance for a Private Company merely because the shareholders belong to one family.

Meaning- “Business Hours”-Section 166(2)

Section 166(2) contemplates , inter alia, that the AGM shall be “called for a time during business hours”. The expression “called for a time” connotes the time specified in the notice of the AGM at which the meeting is intended to begin. The Department has also clarified that it can only be the starting point at which the Meeting is scheduled to commence.(Circular F No.34/1/75 –CL.III dated Nil)Therefore it follows from the above that it is necessary that the Meeting should commence during business hours. There is no bar to the Meeting spilling over beyond the confines of “business hours” as clarified by the Departmental circular F No.34/1/75-CL-III dated nil.. The term “Business hours “ has not been defined in the Act and it should therefore be given the same meaning as applied in common parlance. It refers to the period of time during which an office/shop is open for work. It would therefore be in order if the AGM is held during normal working hours of the company’s Registered office.

Meaning “Public Holiday”-Section 166(2)

The second limb of Section 166(2) enjoins upon the Company not to convene the AGM on a “public holiday’’. Section 2(38) of the Act defines the expression to mean “ a public holiday within the meaning of the Negotiable Instruments Act,1881”.

An inbuilt protection is provided in the meaning of the term to clarify that if ,after the issue of a Notice convening the Meeting on a particular day , the said day is declared by the Central Government to be a public holiday ,in so far as the holding of the Meeting for which Notice has been issued is concerned, the said day shall not be considered as a ‘public holiday” for the purpose of the Meeting. The above insulation ensures that a company can proceed unhindered with an AGM even if the date on which the meeting is convened to be held is declared as a public holiday subsequent to the issue of the Notice for the Meeting.

Explanation under Section 25 of the Negotiable Instruments Act,1881 states that the term ”public holiday “shall include Sundays and any other day declared by the Central Government by notification in the official Gazette to be a public holiday. From the above , it can be inferred that the exception carved out in the definition of public holiday u/s 2(38) supra cannot be applied for the purpose of holding the AGM on a Sunday which is always a public holiday and does not need any notification from the Govt.

Therefore it can be said without exception that an AGM can never be held on a Sunday, save and except through the process of dispensation given by the Central Govt. pursuant to the first proviso to Section 166(2).

Place of Holding AGM

Section 166(2) provides in no unambiguous terms that the Company’s AGM has to be held either at the Registered Office of the Company or within the city, town or village in which the Registered office is located. It is interesting to note as Section 166 is a mandatory provision as stated earlier ,the direction of the Court to hold the Meeting outside the limits of the city, town or village has been held to be invalid in Dinkar Rai Desai vs Bhasin (RP)(1986)(60Comp Cas 4(Del).

The Department has clarified vide letter no.1/1/80-CL-V dated February 16,1981 that a Company can hold its AGM within the postal limits of the city in which the Registered office is located as this would be more convenient to its members.

Central Govt’s Power to exempt-First Proviso to Section 166(2)

The Central Govt is empowered under this proviso to exempt any class of companies from the provisions of Section 166(2).it is pertinent to note this dispensation cannot be given to any individual Company but only to Companies belonging to a particular genre. Pursuant to the above, Section 25 Companies have been spared from requirements of Section 166(2)provided that the time, date and place of each AGM is decided upon before hand by the Board of directors ,having regard to the directions, if any, given by the Company in this regard in General Meeting vide circular No.S.o.No.1578 dated 1/7/1961.

Clauses (a) and (b) of second proviso to Section 166(2)

For facility of discussion, the above is reproduced below:

Provided further that—

(a) a public company or a private company which is a subsidiary of a public company, may by its articles fix the time for its annual general meetings and may also by a resolution passed in one annual general meeting fix the time for its subsequent annual general meetings; and

(b) a private company which is not a subsidiary of a public company, may in like manner and also by a resolution agreed to by all the members thereof, fix the times as well as the place for its annual general meeting.]

A plain reading of Clause (a) above reveals that a public company or a private company which is a Subsidiary of a Public Company, may either by its Articles fix the time for its AGMs and by resolution passed in one AGM fix the time for its subsequent AGMs. The moot point to consider here is whether a Public company or its Subsidiary either by having enabling provisions in its Articles or by resolution passed at an AGM , can decide to hold its Subsequent AGMs at a particular time as also the day of the Meeting even if the day fixed happens to be a public holiday. Such an interpretation is plausible if the expressions “time “ and “day” are considered as synonymous with each other.

As per the Law Lexicon of P.Ramanatha Aiyer , ”Time” is defined to mean “a measure of duration: a space or extent of time”.”Day” refers to “ a certain space of time ,containing twenty four hours’ .Time would denote therefore a sub-set of a duration of 24 hours which constitutes a day .

The above line of interpretation could also perhaps lead to the view that Sub clause (a) above, allows the members of a Public company to fix the time and day of holding the AGM either through its Articles or through enabling authority granted at an AGM in complete disregard to the requirements of section 166(2) which provides as stated earlier that an AGM cannot be held on a public holiday , that it has to be held during business hours and in the place where the company’s Registered office is located.. Put differently can we say that sub-clause (a) above can be read in isolation without any reference to the mother provision namely Section 166(2) In our view, taking the above view may not be correct as both the mother provision and the proviso thereto should be read conjointly .We therefore hold the view that notwithstanding the provisions contained in clause (a) above, the expression “time” would refer to “business hours” as envisaged in Section 166(2).Therefore in our view,, Clause (a) only gives the liberty to the Members of a Public Company to decide in advance the day and time for holding subsequent AGMs which will have to be necessarily be called for a time during business hours and held on a day other than on a “public holiday’’.

Clause (b) above provides to the members of a Private company which is not a subsidiary of a Public Company the opportunity to fix either through its Articles, or through enabling Authority granted by Members, not only the time but also the place for holding the AGM. Here again our view is that the time so fixed should fall within the period of “business hours” and the “place” should be limited to the geographical confines of the place of the Company’s Registered Office.

If a contrary view is taken to mean that both clauses (a) and (b) in the second Proviso are intended to carve out exceptions to the conditionality laid down in Section 166(2) ,to our mind ,Section 166(2) would be rendered in fructuous in the process. In such an eventuality, both clauses (a) and (b) would serve as convenient gateways to enable both public as also private companies to hold their Meetings on public holidays, outside business hours and where private companies are concerned outside the geographic confines of the place of the company’s Registered office, albeit, after following the procedure laid down in the said clauses. This would also in a way defeat the very purpose of Section 166(2) in the Law which is intended to ensure member participation in AGMs by holding them on days other than on public holidays and during business hours.

Relevance of Departmental Circulars on the issue

It would be appropriate at this juncture to discuss the implications of two Departmental circulars on this point.

Departmental letter No.8/16(1)/61-PR dated May 19,1961 reads as under:

“There is no contravention of Section 166(2) if an adjourned meeting comes to be held on a public holiday”.

In our view, that this is a benevolent circular which is intended to avoid causing hardship to a company if the adjourned Meeting convened by it accidentally come up on a public holiday.

The second circular (Letter No.8/5(166)/65 –PR dated 21.1.1963 reads as under:

“Section 166(2) of the Companies Act, 1956 does not now make it absolutely obligatory on every company to hold its AGM only on a day which is not a public holiday. In this connection, attention is invited to the provisions contained in the second proviso to subsection(2) of section 166(2) of the Companies Act which enable a company to fix by its Articles of Association or by a resolution passed in one AGM the time of its AGMs generally or any subsequent such Meeting”

It is respectfully submitted that the above circular does not state the correct position in the law. Section 166(2) states unequivocally inter alia, that the AGM shall not be held on a day which is a public holiday. Sub-clauses (a) and (b) to the second proviso to section 166(2) only provide the flexibility to fix the time and in the case of private companies the venue of the AGM also after due compliance with the procedure laid down therein. Admittedly the circular is benevolent to the Company Management in that it speaks about the possibility of holding an AGM on a public holiday. Having said this, it can be said that the circular cuts across the procedure envisaged by section 166(2).It is settled law that sub-ordinate legislation in the form of rules cannot travel beyond the scope of the mother law and in our opinion, it is humbly submitted that the above circular has no legal force or support.

To summarize our discussion, it is submitted that the provisions of section 166(2) are sacrosanct in so far as the procedure to be administered in so far as holding of AGMs is concerned. Sub clauses (a) and (b) to the second proviso to section 166(2)only facilitate fixing beforehand the time of holding an AGM and in case of private companies the place of the Meeting as well.

We would also reiterate that ,save the exceptions discussed above ,the AGM of a Company has to be held invariably on a day which is not a public holiday ,should commence during business hours and be held in the place of the Company’s registered office.

Position under the New law

Our discussion on the above subject would be incomplete unless we refer to the provisions contained in the new Enactment which is in anvil. Clause 96(2) which corresponds to Section 166(2) in the 1956 Act now defines what constitutes “Business hours” to mean the period between 9 A.M to 6 P.M. The clause also provides that the AGM shall not be held on “National Holiday” which expression has been clarified to include a day declared as a national holiday by the Central Government. It follows from the above that the AGM can now be held on a ”public holiday’ as declared under the Negotiable instruments Act,1881.By inference it follows that the AGM can now be held on a Sunday which is a public holiday.

The existing requirement of holding the AGM in the place of the company’s Registered office is being retained.

In addition, the Central Government shall be empowered to exempt any Company from the requirements of clause 96(2) as opposed to being empowered at present to exempt a particular class of companies as envisaged by the first proviso to Section 166(2).

Conclusion

Based on the above discussion, we would reiterate that an AGM cannot be held on a public holiday by choice, notwithstanding the contents in sub-clauses (a) and (b) to the second proviso u/s 166(2).The above clauses only allow in the case of a public company the flexibility to fix the time for holding the Meeting before hand ,subject to adherence with the compliance envisaged therein .Additionally a Private Company shall have the flexibility to decide on the venue of the Meeting as well.

Some may disagree with the above view and opine that the sub-clauses (a) and (b) ibid carve out an exception to Section 166(2) making it possible to hold an AGM on a pre-determined day and time even if the day happens to be a public holiday. Our .submission is that such a view would negate the contents of Section 166(2) and encourage Companies where the promoters rule the roost to decide by choice to hold the AGM on a public holiday and also hold it outside of business hours and .thus avoid the disquieting glare and introspection by the minority shareholders. This would only cut across the time tested tradition of corporate democracy which is the underpinning of Corporate law.

Limited Liability Partnerships – An Overview

Taking a cue from UK and others wherein Limited Liability form of organisations were already into existence, the Government mooted proposals for introducing Limited Liability form of Partnerships in the year 2006 and finally was made an enactment in the year 2009. A new avenue for entering into partnerships with limited liability entire was therefore opened up for entrepreneurs and professionals as a Limited Liability Partnership has been given a stature of a registered entity.

Taking a cue from UK and others wherein Limited Liability form of organisations were already into existence, the Government mooted proposals for introducing Limited Liability form of Partnerships in the year 2006 and finally was made an enactment in the year 2009. A new avenue for entering into partnerships with limited liability entire was therefore opened up for entrepreneurs and professionals as a Limited Liability Partnership has been given a stature of a registered entity.

The main objective of the Limited Liability Partnership Act, 2009 (“LLP Act”) was to provide a separate form of an organisation distinct from the partners and with a Limited Liability. Also, there was a need to provide an alternative to the Indian Partnership Act, 1932 wherein, the partners were subjected to unlimited liability. The key features of a Limited Liability Partnership (“LLP”) are enumerated hereunder: