Threshold – CSR Strategy

The business community in India is having rounds of heated discussions on the so called ‘Mandatory CSR’ while the world is waiting and watching

out for the outcomes as India will be the first country to (apparently) make Mandatory CSR . Everyone is waiting for clarity on ‘The New Game

Changer’ and contemplating how to apprehend ‘CSR in the Boardroom’! The clarity anxiously sought for is just round the corner once the bill is

passed by the Rajaya Sabha.

The business community in India is having rounds of heated discussions on the so called ‘Mandatory CSR’ while the world is waiting and watching

out for the outcomes as India will be the first country to (apparently) make Mandatory CSR . Everyone is waiting for clarity on ‘The New Game

Changer’ and contemplating how to apprehend ‘CSR in the Boardroom’! The clarity anxiously sought for is just round the corner once the bill is

passed by the Rajaya Sabha.

How we wish we had a far more aware and equally committed consumers (being one of the significant most stakeholders) for ‘shared values’ who

would have looked at this as a great opportunity as the ultimate power will be now vested in them. I feel it is only a matter of time for

them to realize and capture the same.

The question is why have we reached such a stage of ‘Mandatory CSR’ when from the time of inception of industrialization in India, philanthropy and huge genuine charities have gone hand in hand? In fact India has most outstanding examples of giving back to society selflessly and much before the western world could even think of it. The legacy of giving back to society has been continued by many business houses even today, Tatas, Birlas, Bajaj and we have many names from industrialists and service sector of current era too.

The most exemplary of all is Tata group and their trusteeship. Sir Ratanji bequeathed his assets worth about Rs. 80 lakh (8 million rupees)to the Sir Ratan Tata Trust which was founded in1919. Even today about 66% of the equity capital of Tata Sons is held by philanthropic trusts endowed by members of the Tata family.

Before we look into the company bill and relevant sections and the impact on how corporates will need to change the perception as the meager 2% will amplify the manner in which rest 98% of profits are brought to kitty.

Let’s have a look at extremes; that’s todays India: First the Success Story:

‘There is broad consensus that the global center of economic growth is moving to Asia, and as a large emerging nation with a growing middle class, India has captured the attention of developed economies looking for new investment and trade opportunities. By some estimates, India’s economy will grow from its current $1.8 trillion GDP (Gross DomesticProduct) to be the world’s third largest in 2030, with a GDP of close to $30 trillion. A recent report by the National Intelligence Council (Global Trends 2030: Alternative Worlds) states that by 2030, “India could be the rising economic powerhouse that China is seen to be today.” (India’s Emerging Economy: Sector by sector – U.S.- India Insight December 2012)’

Unfortunately ‘The Feel Good’ factor ends right here, let’s have a look at the other side of India: Mr. Sankaran Krishna brings out very clearly in his article ‘The great number fetish’ (The Hindu, Saturday Essay, January 26, 2013).

‘One of the most prominent features of India’s middle-class-driven public culture has been an obsession about our GDP growth rate, and a facile equation of that number with a sense of national achievement or impending arrival into affluence. In media headlines, political speeches, and everyday conversations, the GDP growth rate number — whether it is five per cent or eight per cent or whatever — has become a staple of our evaluations of the state of national well-being and future trajectory. Ever since Goldman Sachs (an investment banking firm headquartered in New York city) released a report in 2003 (“Dreaming with BRICs: the path to 2050”) touting Brazil, Russia, India and China (BRIC) as the harbingers of a new wave of global accumulation, we Indians have been afflicted by an optimism disease with little empirical traction. Since then, the GDP number’s implications for India’s development, her attractiveness as an investment site, our standing relative to China, and our competitiveness in the games nations play have become an inescapable part of our social lives.’

“Ever since Goldman Sachs released a report in 2003 touting Brazil, Russia, India and China (BRIC) as the harbingers of a new wave of global accumulation, we Indians have been afflicted by an optimism disease with little empirical traction.” File photo shows Goldman Sachs headquarters in New York.

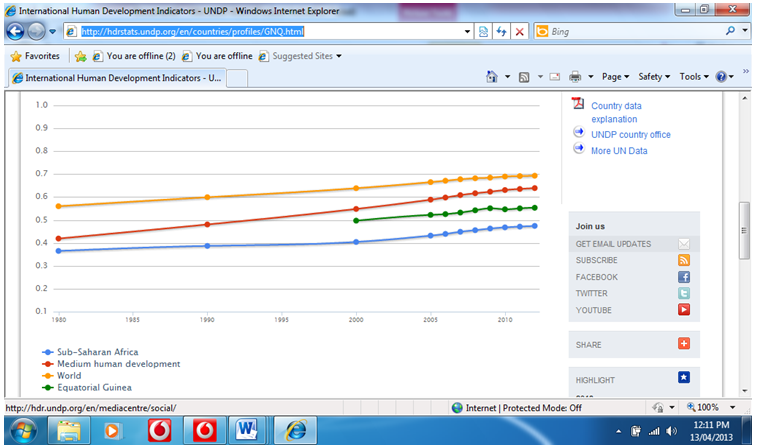

In the same article there are some more distressing revelations: Fast growth, limited results

‘Yet, in a recent essay, the eminent economists Amartya Sen and Jean Drèze pointed to an important problem with equating India’s economic performance with its GDP growth rate. They noted: “There is probably no other example in the history of world development of an economy growing so fast for so long with such limited results in terms of broad-based social progress.” Sen and Drèze were referring to the fact that for about 32 years now (since 1980), India has averaged annual GDP growth rates of approximately six per cent — whereas, the nation’s ranking in terms of the Human Development Index has remained unchanged over that period: we were ranked an abysmal 134 in 1980, we were ranked exactly that in 2011.’

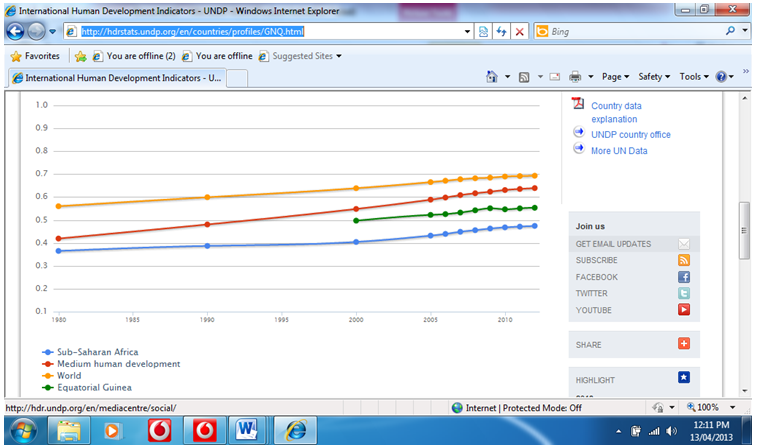

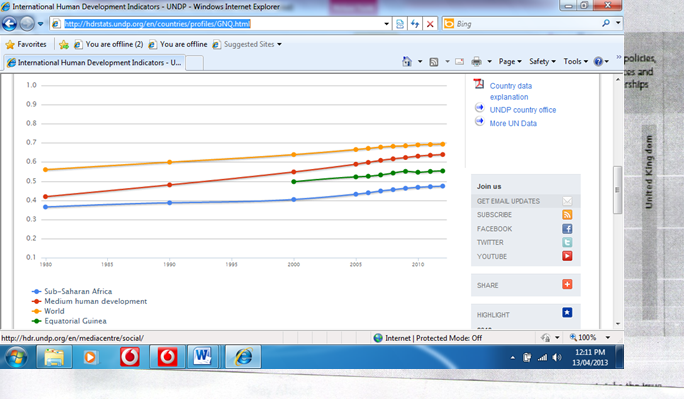

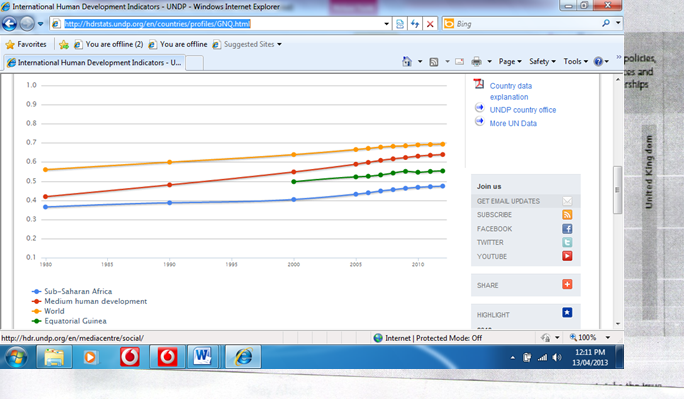

And as if this is not enough let us see ‘UNDP brackets India with Equatorial Guinea in human development index’

‘India has been ranked 136 among 187 countries evaluated for human development index (HDI) — a measure for assessing progress in life expectancy, access to knowledge and a decent standard of living or gross national income per capita.’

The Human Development Report of the United Nations Development Programme (UNDP) for 2013, released on Thursday, puts India’s HDI value for the last year at 0.554, placing it in the medium human development category, which it shares with Equatorial Guinea. (The Hindu, NEW DELHI, March 15, 2013, Special Correspondent)’

Somehow we need to keep an eye on our HDI and not get flabbergasted by euphoria of higher GDP and look within for improving HDI index as well. The picture and caption captures it all:

Somehow we need to keep an eye on our HDI and not get flabbergasted by euphoria of higher GDP and look within for improving HDI index as well. The picture and caption captures it all:

The Hindu, SATURDAY ESSAY,The great number fetish, Sankaran Krishna January 26, 2013 India as a nation and society, we need to look within for answers and find new equations and ways so that GDP and HDI are at least at equally promising levels. The need of the hour is coming together of the government, industry, enterprise and civic society comprising all areas including NGOs.

Before we look in to significance of CSR let us see where India stands in “the results in cooperation with the Deutsche Gesellschaft für Technische Zusammenarbeit (GTZ). This collaboration proves the importance CSR has recently gained for private and public sector actors. Cooperation is both the basis of this study and the principle underlying CSR.

The CSR Navigator - Public Policies in Africa, the Americas, Asia and Europe: Profiling and Navigating CSR public policies in Africa, the Americas, Asia and Europe

“The present international study – the first of its kind – is a systematic analysis of CSR policy in 13 different

countries and it aims to demonstrate which policy tools are best able to promote corporate social engagement.

“Political, economic and social leaders need to join together to meet the social, ecological and cultural challenges of globalization. Whether in Europe, Africa, Asia or the Americas, it is becoming more and more important that all societal actors contribute to solving the complex problems we face. This means we must redefine the rules determining how we live and work together.

Businesses can be particularly effective in helping to improve living conditions for people throughout the world. Thus, more than ever before, long-term entrepreneurial planning and action must be coupled with a sense of social responsibility. This core conviction has always informed the Bertelsmann Stiftung’s project work.

“We are convinced that such cooperative efforts are the key to shaping globalization in a sustainable way.”

The study states ‘CSR policymaking can develop when it builds on a country’s existing instruments and identifies

Deficits in key focal points: the economy, civil society, politics and strategies for cooperation.

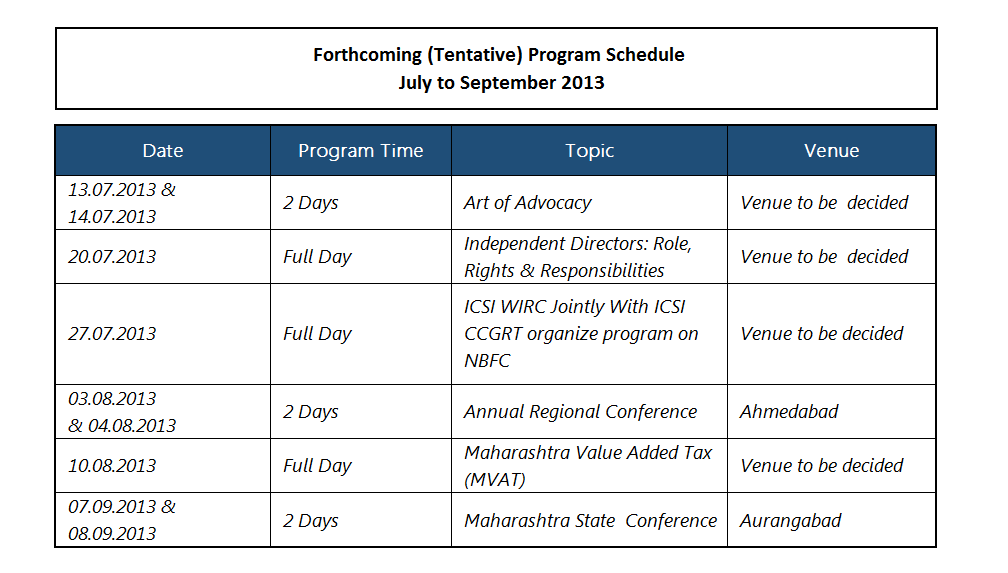

The diagram below depicts the focus of future CSR development in the countries investigated

I - 01 CSR Generations

The findings of The Navigator:

The findings of The Navigator:

CSR Public Policy Maturity Level

First generation:

• Some activities are in place, such as encouraging the employment of backward castes in the private sector

• Stakeholders are taken into consideration sporadically

• The level of communication is low

• Evaluation by the government does not take place

CSR Recommendations

• A coherent CSR strategy is to be clarified and developed, international standards should be applied

• Local business especially SMEs are to be incentivized more to take up the subject

• Addressing the issue of implementation, stressing voluntary initiatives and incentives

• CSR should be used to give voice to deprived groups

• Arriving at greater agreements on CSR by state, business and societal actors

With above background, it is high time that we look at CSR as a part of our strategy to ensure a progressive and prosperous society and nation. That brings us to the core question ‘Why strategic CSR?’

What impact can CSR make, let us see some figures as per Suresh Nandi, Feb 3, 2013, DH News Service, PSUs fail to bridge the social responsibility gap, Deccan Herrald, ‘interestingly, one report points out that Indian listed companies had a combined net profit of Rs 4,37,167 crore last year. At 2 per cent, this will yield slightly less than $2 billion a year as the CSR kitty of India Inc, and such a large sum generated every year could solve many of the country’s social and environmental issues.’

The question is do we have the resolve, commitment and leadership at business & enterprise level that can make it happen.

Let us now look at different facets of the question ‘Why CSR?’

First let’s recall series of events in the 1980s and the 1990s that were catalysts to force companies to address the issues of their responsibility towards society and the environment. Events such as:

• The battle between the environmentalists (led by Greenpeace) over the proposed Sinking by Shell of their Brentspar oil platform; the sinking of the Exxon Valdez and the

consequent pollution of the Alaskan coast line

• The fraudulent activity of the management of Enron leading to its collapse

• The plundering of the Mirror Group’s pension fund by its owner, Robert Maxwell

• The collapse of WorldCom

• The issues surrounding TyCo International and its former Chief Executive, Dennis Kozlowski

Also what first few years of the twenty-first century brought before us:

• The debate about the ethical product sourcing practices of companies such as Nike and Gap

• The development of FairTrade products – initially sold in more ethically minded retailers such as the Co-Op but now seen in shops across the retail spectrum

• The publication of the Stern Review on the Economics of Climate Change and the release of Al Gore’s film ‘An Inconvenient Truth’

• The discussion about the ethical behaviour of the world’s banking and finance system in the run up to the 2008 financial crisis

• The environmental disaster resulting from the fire and explosion on BP’s Deepwater Horizon rig in the Gulf of Mexico in April 2010

Why has CSR become significant?

The blinkered two-faced changes in world society and politics, alarming developments regarding climate change in the early twenty first century were influential

in creating awareness and new dynamics for shift in outlook. Ubiquitous apprehensions of changing world-order were further mobilized by several significant

developments that made the manifestation more fertile for the creating distinct need for CSR, some of them are:

• Wider shareholder franchise

• Globalization

• Social, Political & Economic initiatives

• Corporate mis-governance / indifference

• Changing world politics

• The internet & Social media

• Public recognition of climate change

• Evolution of the phenomenon called ‘Stakeholder Engagement’

• Communication and dissemination of information not dependent on pure literacy

To add to above major drivers for CSR, there are many other reasons which demand adherence to CSR

• CSR pressure is increasingly bottom up, not top down

• As the world’s top brands rush to adopt new marketing methods better suited to digital media, most

• companies are continuing to utilize the same dry, dull approaches to convey their efforts in CSRs

• Social responsibility and sustainability:

• An annual report buried deep in some back page of a corporate website

• Boring statistics and percentages proving a reduced eco footprint since last quarter

• Enough jargon to guarantee alienating everyone outside of seasoned, though still yawning – professionals

• ‘What matters to your customer has to now matter to your business’ - will have to be concerned what matters to your customers and make a note of it

• Learning how to create ‘shared values’ is not a strategy, but a necessity for any business looking to thrive in a market driven by new media

• CSR is Here to Stay -The fact remains that, despite its critics, a rapidly growing number of companies in the world practice some form of CSR: At last count,

more than 3,500 companies were part of the Global Reporting Initiative, and had issued more than eight thousand environmental and social sustainability reports.

This number was less than 1400 just two years ago. In a 2008 Economist online survey of 1,192 global executives, an estimated 55 percent reported that their companies

gave high priority to corporate responsibility. The number was projected to increase to 70 percent by 2010, demonstrating that a rapidly increasing number of companies

across the globe are committed to CSR practice, and many more are increasingly entering the fray.

With passing of time they will have to pay attention, rather look at stakeholders’ demands out of deference and just not the obligation.

Potential challenges can also emerge from a recalcitrant attitude towards CSR. Further down in this article I have covered ‘What is the business case for CSR and Key

potential benefits for implementing CSR’ – missing out on one or many could be detrimental to the organization.

To substantiate points covered above let us look at the vulnerability of corporates who take the decisions based on pure business strategy and are forced to bring the

commercial/ industrial activity to a complete halt. The days of ‘might is right’ seem to be losing its weight, today one has to carry every one along with the road of

prosperity and care for those at whose instance and displacement one manages to amass unreasonable wealth due to sheer power.

We cannot afford to miss quoting of a timely and most appropriate article to illustrate what has been written above. The Economic Times, April 19, 2013, Friday on page 5,

Corporate states “SC Leaves Vedanta Projects’s Fate in the Hands of Gram Sabhas – Gram Sabhas to take a call on Niyamgiri mining; co to get final word after 5 months”.

An eye opener for any person interested in understanding what it means when we talk of ‘Sustainability’. The article further states, “…the question whether Schedule

Tribes and other traditional forest dwellers (TFDS) Dongaria Kondh, Kutia kandha and others have got any religious rights – rights of worship over Niyamgire hills …. have

to be considered by the gram sabha,” the bench said.

On Page 14, The Edit Page is an interesting article ‘The Niyamgire lesson for the Vedanta chief: even bold dealmakers have to manage perceptions – Being Anil Agarwal’

an interview with Mr.R Sriram. The article reads ‘Hostile Global NGOs – Tribals are often smarter than city dwellers. They know the advantages of proper schools,

housing and a decent standard of living, and are unlikely to dismiss sincere outreach efforts. But for that to happen, Agarwal needs to be sensitive to their religious

feelings.

‘Here’s the reason why he needs to do this: Vedanta has somehow acquired this public image of being hostile to environment and the habitats of tribals and villagers.

It has faced a lot of flak from global NGOs that have accused it of riding roughshod over tribal rights, and this has started to affect Vedanta’s reputation.’

Do we need to elaborate further? What will happen to brand equity, stocks and over all position of the company?

Company Bill & CSR

With the above description we can now look at Company Bill with reference to CSR. The changes in the bill have created a serious debate on apparently ‘Mandatory’ status of

the feature. There are different views expressed by experts and the debate will go on for a while. One needs to interpret the section in holistic perspective and though word

‘shall’ is used in the section the thrust is on words in sub-section 5 which states “Provided that if the company fails to spend such amount, the Board shall, in its report

made under clause (o) of sub-section (3) of section 134, specify the reasons for not spending”.

According to this the emphasis is on management’s reporting the failure of capturing the opportunity to strategically contribute to the community and go beyond seeing only

‘shareholders’ ’ interest. This should bring in the concept of ‘stakeholder engagement’ and moving towards it systematically. ‘Stakeholder engagement’ is a more matured

approach that alone can bring ‘sustainability’ and is being seen as the just way all over the world.

Even otherwise when businesses are inter-dependent globally either as customer, supply-chain, finance & investors and service providers, businesses in India of all sizes

& sector, will have no option to look at CSR with serious commitment lest they may have to opt-out of the global business fraternity. Europe is looking forward for structured

& strategic changes for bringing in CSR reporting by the business. There are number of plans and activities taking place, let me quote here some remarkable facts from Europe

2020 Strategy:

“Chapter three can be seen as the most important progress that the new CSR Communication provides, as the Commission puts forward a new definition for CSR which creates a

really new perspective. While the previous communication (and a great number of publications which took up this perspective) defined CSR as “a concept whereby companies

integrate social and environmental concerns in their business operations and their interaction with their stakeholders on a voluntary basis”, the new Communication defines

CSR as “the responsibility of enterprises for their impacts on society”.

To emphasize the need that European CSR policy should be made fully consistent with internationally recognized principles and guidelines, several of them are quoted.

Compared to the previous Communication, several new international documents were integrated into this list of references (e.g. Single Market Act, Public Procurement

Directives, UN Principles for Responsible Investment). However, two of the most important reference documents of sustainable development policy are no longer quoted in

the new Communication: the European Sustainable Development Strategy (EU SDS) and the Millennium Development Goals (MDGs). This remarkable fact might be explained by a

loss of practical importance of the EU SDS compared to the Europe 2020 Strategy (which is quoted several times), and by the high importance of Human Rights (which might

be perceived as the business responsibility while the MDGs might be seen rather as the responsibility of states and international organizations). From the content point

of view, several objectives of the EU SDS (e.g. biodiversity, resource efficiency) are emphasized in the chapter on the multidimensional nature of CSR, while most of the

objectives of the MDGs are not touched (e.g. global partnership, fighting poverty and hunger; health is just limited to employee health).”

(Focus CSR: The New Communication of the EU Commission on CSR and National CSR Strategies and Action Plans)

Not only Europe, even Japan and many other countries are focusing on CSR as strategy to be followed.

Will Business Inc. of India be able to disregard the new reckoning and still prosper or rather even survive is a question.

Mandatory, voluntary, applicable to who, why and how to go about it are some of the common questions being asked by the businesses today. Mandatory or not including CSR

as a strategy will by and large change our mindset and the way we conduct our enterprises today. It will integrate community and business in true sense as they become

integral part of the society and learn to trust each other for common welfare. And hopefully this new learning will manifest in an all-inclusive & matured society, obviously

a far better place to live. The details of the section are as per Annexure…

What is CSR?

Definition of CSR:

Can we define CSR in just one exhaustive definition? The answer is no and difficult. For one most significant reason is that it is still evolving as the outlook of society

is becoming more vigilant towards the manner the businesses are conducted and polarization of the society in extreme wealth concentration by handful on one side and enormous

mass of hapless poor on the other hand due to such self-centered attitude. To an extent the businesses themselves are looking at deeper, broader and scalable result oriented

outcomes as the ‘sustainability’ of business is one of the biggest challenges today.

MNC’s prefers sustainable development or sustainable business while Indian perspective is responsible business or Triple P (People, Planet, and Profit).

Let us have a look at some of the definitions:

It is important to note that Indian companies and stakeholders give a broader definition of CSR then MNC and stakeholders. According to the Indian Corporate:

“Sustainable development implies optimizing financial position while not depleting social and environmental aspects and CSR implies supporting issues related to

children, women and environment”.

The World Business Council for Sustainable Development’s (WBCSD) definition of CSR states “Corporate Social Responsibility is the continuing commitment by business to contribute

to economic development while improving the quality of life of the workforce and their families as well as of the community and society at large."

The European Commission puts forward a new definition of CSR as “the responsibility of enterprises for their impacts on society”. Respect for applicable legislation, and for

collective agreements between social partners, is a prerequisite for meeting that responsibility. To fully meet their corporate social responsibility, enterprises should have

in place a process to integrate social, environmental, ethical, human rights and consumer concerns into their business operations and core strategy in close collaboration

with their stakeholders, with the aim of:

– Maximizing the creation of shared value for their owners/shareholders and for their other stakeholders and society at large;

– Identifying, preventing and mitigating their possible adverse impacts.

What else is also looked at as CSR?

An additional challenge for narrowing down scope of CSR and arriving ta one universal definition arises from the fact that several terms exist, which are used similarly;

Corporate Responsibility, Corporate Sustainability, Business Ethics. The most prominent concepts close or similar to CSR are:

• Corporate Social Responsiveness - Vallentin 2009

• Corporate Governance - Yoshikawa and Rasheed 2009

• Corporate Social Performance (CSP) - Martínez 2008; Carroll 1999; Wood 1991; Wartick and Cochran 1985;

• Corporate Sustainability - Schaltegger and Burrit 2005; Steurer, Langer 2005

• Corporate Philanthropy - Seelos and Mair 2005

• (Corporate) Social Entrepreneurship - Seelos and Mair 2005

• Corporate Citizenship - Matten and Crane 2005; Rondinelli and Berry 2000

• Social Responsibility Dhillon 2002

• Business Ethics - Göbbels 2002

National & Global Instruments which can support CSR implementation and can be used for stating strategy:

Among the better known international instruments which make up "an evolving and increasingly coherent global framework for CSR" are as under

(the list is indicative, not exhaustive):

• National Voluntary Guidelines on Social, Environmental & Economic Responsibilities of Business

• The Organization for Economic Co-operation and Development (OECD) Guidelines for Multinational

• Enterprises

• The 10 principles of the United Nations Global Compact

• ISO 26000 Guidance Standard on Social Responsibility

• United Nations Guiding Principles on Business and Human Rights

• International Labour Organisation (ILO) Tripartite Declaration of Principles concerning Multinational Enterprises on Social Policy and Core Labour Standards

• Corporate Social Responsibility: An Implementation Guide for Business

• The Global Reporting Initiative (GRI) Sustainability Reporting Guidelines

• The Accountability AA1000 Series

• The Social Accountability International SA8000 standard (multi-stakeholder auditable standard)

• Amnesty International’s Human Rights Principles for Companies

• Ethical Trading Initiative (ETI)

• Principles of Global Corporate Responsibility- Measuring Business Performance

• Global Corporate Responsibility

Before the present company bill was introduced in the Parliament, PSUs were already roped in for structured CSR guidelines.

Public Sector Undertakings guidelines & Challenges faced by PSUs:

Public Sector Undertakings (PSUs) have to follow Guidelines on Corporate Social Responsibility and Sustainability for Central Public Sector Enterprises effective 1st April

2013 which covers major areas for implementation.

Further Department of Public Enterprises, Ministry of Heavy Industries and Public Enterprises, Government of India, has recently set up the National Corporate Social

Responsibility Hub (NCSRH) at the Tata Institute of Social Sciences. PSU’s will work with NGOs registered with Tata Institute of Social Sciences (TISS) for their CSR projects.

Implementing CSR is totally different and even more challenging then running an enterprise for profit alone, to some extent though and will depend upon the collective leadership of the organization.

The organization must be open to it, accept CSR as part of its business strategy at all levels and involve the entire workforce for grand success. CSR is not a domain specific

or technical expertise of an individual or the team. The foundation of CSR is based on intrinsic feeling for “shared values”. The leadership at top must have competence

to nurture, motivate, assist, support, facilitate and scale-up this new arm of conducting the main business.

Ad probably this is the reason that in spite of huge availability of funds and a very high level of professional management, PSUs are hard-pressed to deploy available funds

for CSR – so obviously it is something beyond charity, donation or even ‘parking money’.

Let us some of the challenges faced by PSU’s:

• Problems finding good social projects most of the time – for example Six PSU’s mandated to spend Rs 1,203 crore in FY12, only one-third disbursed

• The bigger challenge for PSUs is in finding sustainable projects, more so in Tier II and III towns

• Want of dedicated professionals who can ensure that the CSR money is spent well and judiciously

• Loosely-held bureaucratic structures cause delays in money reaching projects, which in turn results in the inability to spend allocated funds within a specified time period

• Lack of

• Partnerships with NGOs

• Common language and work ethos between professionally driven corporates and NGOs who are still struggling to imbibe professionalism (majority of them)

• Top management’s vision for CSR

• Dedicated teams, with one person handling two or three functions with CSR as an added responsibility

• CSR is a ‘department’s role and responsibility’ unlike percolating ethos throughout the organization, it is just another business vertical in silo

• Competencies to address issues which are different from their particular industry and core competencies

The brighter aspect is that the internal stakeholder engagement is becoming receptive to the notion, that there is the mindset shift of top managements of companies;

to an extent that leaders at the level of COOs are also now sitting in the meetings of CSR initiatives.

What is the business case for CSR?

The business case for CSR will differ from organization to organization, depending on a number of factors. These include size, products, activities, location, suppliers,

leadership and reputation (i.e., of the sector in which the organization operates). Another factor is the approach taken for CSR, which can vary from being strategic or

responsive and incremental on certain issues to becoming a mission-oriented.

Key potential benefits for firms implementing CSR include:

• Risk Management – Environmental, financial and reputation

• Improved human resources practices, recruitment and retention

• Ideal stakeholder engagement

• Enhanced operational efficiencies and cost savings. These flow in particular from improved efficiencies identified through a systematic approach to management that

includes continuous improvement.

CSR – Economic topics:

• Pursue sound corporate governance practices

• Ensure transparency through economic, social & environmental reporting

• Engage in fair competition

• Foster innovation

• Combat bribery & corruption

• Employ Socially Responsible Investment

• Protect intellectual property rights

• Offer safe and high-quality products/services

• Foster sustainable consumption & production

• Implement sound risk management systems

CSR – Environmental topics

• Support the protection of air and water, land biodiversity

• Minimize the amount of toxic substances, emissions, sewage and waste

• Conserve natural resources, apply renewable energy & avoid the usage of raw materials

• Engage in climate protection

• Boost innovation for improvement in efficiency

• Consider the whole product life-cycle, facilitate reusability & recyclability of products

CSR – Social topics

• Engage in fair and efficient Human Resource Management

• Guarantee safety, occupational health & security

• Respect freedom of association

• Abandon discrimination & encourage diversity

• Respect consumer interests

CSR – Global topics

• Raise stakeholders’ awareness for social & environmental topics

• Practice sound stakeholder management

• Facilitate sustainable supply chains

• Respect Human Rights

• Engage in poverty reduction

• Participate in the development of public policies

• Improved ability to attract and build effective and efficient supply chain relationships.

• Enhanced ability to address change

• CSR can help build “social capital.” Community acceptance, respect and support

• Access to capital

• Improved relations with regulators

• A catalyst for responsible consumption

Who are stakeholders & what stakeholder engagement is:

Like CSR there are various definitions and connotations. To get the broad idea it is defined as “Stakeholder engagement is the process by which an organisation involves people who may be affected by the decisions it makes or can influence the implementation of its decisions. They may support or oppose the decisions, be influential in the organisation or within the community in which it operates, holds relevant official positions or be affected in the long term.”

Companies engage their stakeholders in dialogue to find out what social and environmental issues matter most to them about their performance in order to improve decision-making and accountability. Engaging stakeholders is a requirement of the Global Reporting Initiative (GRI), a network-based organization with sustainability reporting framework that is widely used around the world.

Stakeholder Management is essentially stakeholder relationship management as it is the relationship which can lead to amicable stakeholder engagement.

A general stakeholders list will include:

Civic society & community, financial institutions, Regulatory bodies, Supply chain, Local bodies, Media, NGOs, Unions, Consumers, Customers, Human rights group, Workers, Employees, Shareholders, Government, Equity Placement agencies, Trade bodies, Councils any such entity which can be benefited or aggrieved by conduct of the management.

The above is generic list; the stakeholders’ profile will change and depend upon the actual activity of the organization.

Fundamental focus areas for CSR success:

1. Must have top management’s commitment, entails leadership qualities which percolate down the organization

2. Clarity & focus on mission & purpose: Clearly defined CSR goals will enable to create competitive advantage through CSR. Align CSR strategies with organizational goals and

capabilities

3. Selection of CSR project: CSR activity should be an extension or close to core business as much as possible and will enable holistic value-add,

consistency and motivating results for the management team and beneficiary partners

4. Selection of Potential Partners: Businesses and nonprofits often are looking to partner with companies that are committed to corporate social reasonability.

Selection of the partners and decision to associate must be taken after due verification and credibility. Chances are that in spite of the best motives and commitments

even accidental association with the wrong partner can defeat the purpose or could lead to a CSR disaster. Regenerating interest across the organization can be a challenge

and can tarnish the name as well

5. Geographic location: working on one’s strength always has a multiplier impact, selection of CSR projects in and around Corporates business units yield better, visible

outcomes

6. Strategy & Planning: Strategic planning, economic and management sustainability, monitoring, scalability, succession and exit policy after 3 to 5 years depending upon

the project are some of the core areas which need focus. The activity should continue on its own or a smaller external support. The endeavor should be that today’s beneficiary

partners should shoulder the role of becoming a contributor of future and this should be part of policy & process

Let us see how strategy can be a safe guard as risk management: a major disaster

“Without ties to environmental leaders, Exxon had nowhere to turn for advice after the oil spill.

It wasn’t until the Exxon Valdez oil spill in 1989 that the shortcomings of that style of philanthropy were fully exposed. Without ties to environmental leaders

nurtured by the foundation, then Exxon Chairman Lawrence G. Rawl had nowhere to turn for advice on handling the crisis.

Meanwhile, Arco, one of Exxon’s competitors, had been using philanthropy strategically since 1971, when it began funding and forming alliances with environmental groups. The resulting partnerships and informal environmental education taught Arco executives to respond quickly and openly when accidents occurred. In turn, environmental groups depended on Arco to testify in support of legislation, such as California’s Clean Air Act, which addressed both business and environmental concerns.” (Harvard Business Review on Corporate Responsibility)

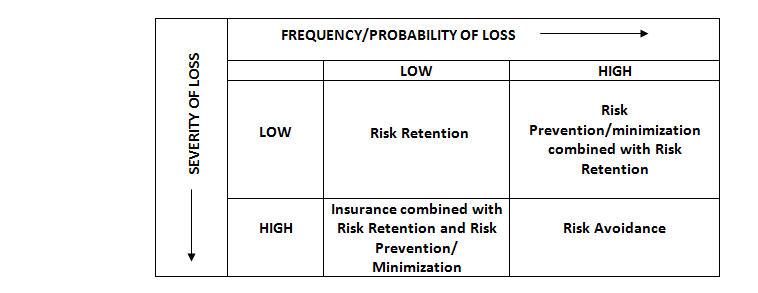

7. Risk Management: Assess risks and opportunities before making capital investments or other business decisions, evaluate and understand how CSR directly affects current

and future regulatory practices

8. All inclusive, across organization: Companies should look at CSR as a 360 degree perspective- including their business processes, people & planet policies, regulations

and compliance and avoid charity and donations. This will enable building of brand equity almost by default.

Experiential outreach for everyone in the organization should be an organizational effort and not a departmental ‘Role & Responsibility’ realization that will percolate

down the entire society. Unless it becomes the way of life we will keep on debating on various aspects for not doing it.

Specific effort should be made so that today’s young generation look at it integral part of their work in any capacity or role.

9. Commitment, Honesty, Transparency & Accountability: Honesty & Transparency will enable the organization to sail through difficult phases and establish credibility. The CSR project should be for implementation and not for sake of ‘reporting’ or else it can boomerang, impair the brand equity.

Marianne M. Jennings brings this out beautifully, “Pressure to Maintain Those Numbers

Antidote #1 for Pressure to Maintain Those Numbers: Surround Goal Achievement in a Square Box of Values

If you tell employees nine time a day to “meet those numbers” and then remind them once a year in a superficial training session on ethics to “ never do anything unethical,” which direction will they follow? I have helped many companies and organizations with their once-each-year ethical training, and I am pleased to help. But a once-a-year reminder session on ethics does not provide a sufficient antidote to numbers-pressure culture. One annual session on ethics does not an ethical culture make!” ' The Seven Signs of Ethical Collapse, , J.D., page 44-45

10. Authenticity & credibility: Social audits for authenticity & credibility – this will help accurate reporting and enable desired monitoring for PDCA for the management

and outsourced partners (NGOs / associates /facilitators / consultants) as well.

11. Stakeholders versus Shareholder:

Benefit of this approach towards corporate governance is that it recognizes the broad objective of maximizing shareholder value, whilst acting fairly in the interests of other stakeholders

Challenges for SR in India:

Earlier in the article I have already covered challenges faced by PSUs and list can be unending! Let us look at some more possible challenges:

• Difficulty in making a business case for CSR, difficulty in integrating CSR with organizational values and practices, and the lack of organizational buy-in and

commitment to CSR

• Accuse companies of treating CSR as a kind of public relations exercise, managements do not let go of the smallest opportunity to get mileage from CSR.

• Mindset ‘shareholder’ reaction driven – shareholder a ‘mini corporate looking at investment with multiplier impact’

• Long way to go for true ‘stakeholder engagement’

• Consumers yet to grasp ‘sustainability’ in larger context then ‘just the best value for money

• Lackadaisical attitude of citizens / consumers commitment / awareness to CSR / SR / Sustainability

Desired competencies & experience for selection as a facilitator for CSR projects:

Selection of consultants / facilitator

• Breadth of Experience: Exposure to different business categories, corporations and not-for-profit organizations, small and large businesses, application of CSR

in a wide range of situations

• Depth of Experience: passion about CSR is a must but one needs to balance enthusiasm with experience and professionalism

• 3. Diversity: access to a wide range of different opinions, ages, genders and ethnicities.

• 4. Capacity Building: Willing ness and ability to create strong in-house team which can continue the activity

• Capacity of understanding nature and process how social changes work as they take longer times to percolate effectively in the area of work, community

• Attitude: provocative and positive

• Knowledge: Global & national instruments and latest position of CSR

• Adequate knowledge / background on local laws

• Attitude: Own commitment towards ‘shared values’, values & principles, having heart for social causes 7 commitment

To sum up:

• Barring few top business groups and corporates there is a leadership vacuum as far as CSR commitment is concerned – these groups are also not in position to demand

or even create awareness about CSR in supply-chain as they then lose the competitive edge. CSR is a distant expectation; most of them have not even managed to demand

compliance from their supply-chain for the same reason, unless they are implementing or making an effort to implement one or other instrument mentioned above.

• Total disconnect with significance attained by CSR world over and hence no realization of possible challenge to survival or sustainability

• Businesses having exports give-in to adherence to ‘compliances’ (to an extent again and mostly unwillingly) for getting business and feel that this will enable

sustainability too

• Huge local consumer base which does not really care for CSR or even ‘compliances’ as long as they can buy at cheapest price.

Let us take one example. Unfortunately even after 65 years of independence, the general civic mindset with reference to ‘child labour’ is that ‘India is a poor

country and we cannot do without child labour. Children have to work to support their family!’ (If we check their need to work full time and even in hazardous

conditions, the reasons could be many and just not the poverty alone. The reasons too point fingers at our callous attitude). Are we a confused lot – are we a

promising nation or an utter disaster as a society, we need to look within.

If this is our level of commitment towards all-inclusive society and self-esteem as a nation, we are undoubtedly ages behind to even think of “the responsibility of

enterprises for their impacts on society”.

• No vision beyond shareholders’ interest and the bottom line

• Absence of ‘Lead by action’ examples – be it political, civil or enterprise level

• Banking and financial fraternities generally (other than equity placement) do not see CSR investment (not even statutory compliances) as a sustainable business

practice nor demand it. There is an absence of policy & strategy at the top management level to demand CSR implementation from their customers. This is in spite of the fact

that they are exposing themselves to huge risk if they do not check whether the customer has undertaken proper due diligence on Environment Impact Assessment (EIA), Social

Impact and Equator Principles and such other requirements

• ‘Intangibles Assets’ could go way beyond in financial valuations over a period of time and create a brand equity which can stand any disaster – the businesses

do not pay heed to it, the age old myopic vision, the bottom line equation

• Reluctance to change and even experiment

• Absence of realization on this accord i.e. CSR even amongst the so called elite, affluent and /or even intellectuals, there are no debates, discussions at any level

• Media which can be positively instrumental has to realize the role it can play and the cost of omission of the same as of now (probably being part of the same apathetic society)

The Ministry of Corporate Affairs through changes in the Company Bill on CSR has placed tremendous power and faith in the hands (the correct word would be hearts!) of

citizens of India and the civic society as stakeholders. Hopefully they will assume their responsibility with accountability and propriety by bringing the desired positive

results so that we have a better place to live for all.

The owners of the process are Company Secretaries and hence they can be the true torch bearers and light! Lest even CSR can go Corporate Governance way and the Company Secretaries will end up paying price for ignoring importance of ‘Values & Principles’.

Before I close let me share ‘Company secys in the Line of Fire’, one more eye-opener, especially for the company secretaries and managements.

The Economic Times, front page (and corporate 5), April 19, 2013, Friday; “Over 120 company secretaries have quit in the past three months as small-and mid-sized firms grapple with governance issues.” To quote few top brand companies as given in ET are S Kumars Nationwide, Birla Power, Muthoot Finance, ABG Shipyard….

And to conclude we have Hope and the Road Ahead:

‘However, as the saying goes, the third time is the charm. Having witnessed three cycles of ethical collapse, I see that the patterns are clearly defined, the signs universal, and the outcomes similar in their disastrous impact. But with this third round of observations, I have also discovered that there are antidotes. If organizations can just work at applying them, the inevitable need not occur. Ethical collapse is not a natural market adjustment - it represents utter defiance of the principles of fairness and morality that markets and capitalism demand. If we are to continue to enjoy the magnificent benefits of the free market, we must be prepared to self-govern through ethical choices. We must also be willing to put into place the checks and balances that ensure such self-government via the free market work. Virtue ethics coupled with a healthy dose of antidotes are the key to preventing ethical collapse.’ The Seven Signs of Ethical Collapse, Marianne M. Jennings, J.D.

Company Bill Sec 135

Explanatory note on the section and general points:

1. Presently only the section is available for public disclosure. Though the ministry has framed rules the same shall be made public only after the bill is passes by the Rajya Sabha and it is declared act

2. The spend is not mandatory if we see the articulation in holistic manner. The mandatory obligation is reporting which is given in section 135 (5):

The section states:

The Board of every company referred to in sub-section (1), shall make every endeavour to ensure that the company spends, in every financial year, at least two per cent of the average net profits of the company made during the three immediately preceding financial years, in pursuance of its Corporate Social Responsibility Policy:

Provided that if the company fails to spend such amount, the Board shall, in its report made under clause (o) of sub-section (3) of section 134, specify the reasons for not spending

3. In view of the above failure to ‘reporting’ becomes mandatory. If the company spends on projects as per schedule VII the report will cover the activity undertaken and outcome of the same.

Either way the management becomes vulnerable at the instance of stakeholders or the list of stakeholders is ever increasing one. Again here the power is vested outside the shareholders who are stakeholders just by default.

Ironically it is ‘and/or’ situation for the management of the companies: if they implement half-heartedly or do not implement at all. Either way they are at the mercy of the stakeholders.

The accountability will be on the committee but further details on the same will be available once the rules are declared. Under all circumstances the process holder will be the Company Secretary and hence undertaking all activities as per section 135 will have to be followed by the CS.

Understanding what is HDI (Human Development Index) and its relevance to the countries overall civic society is very vital. The government is short listing backward districts, around 272 or so. The government is going to seek adoption of such districts by willing corporates.

4. Do all Companies have to do CSR?

Every company having a net worth of Rs. 500 crore or turnover of Rs.1000 crores or net profit of Rs. 5 crore or more has to constitute a “CSR Committee of the Board” consisting of at least 3 directors and out of these three directors, one has to be an independent director. This is a foolproof provision ensuring that the committee is not just a quasi committee addressing the whims of the board but is in fact taking up an initiative.These companies have to spend minimum 2% of “net profits” (Average of last three years) towards CSR policy. If not spent, board has to give detailed reasons for not spending on CSR in the Director’s Report.

5. Duties of the Committee as per Clause 135

The main role of the committee is to formulate and recommend to the Board a Corporate Social Responsibility Policy which should indicate the activities to be undertaken by the Company.

Additionally, the Committee has to also recommend the quantum of expenditure to be incurred on these activities. Finally, the Committee has to monitor the Corporate Social Responsibility Policy of the company from time to time.

6. The reporting format also will be available ones the rules are declared.

Presently as a CS one should inter-act focus on schedule VII and generally short list areas of possible interest and discuss the same with board in light of Fundamental focus areas for CSR success and Generic Topics in the article.

7. The CS will have to gear up for facing / responding to the queries of the stakeholders and may have to set a process for the same so that the stakeholder engagement is undertaken in the proficient manner across the organization and across all geographic locations.

8. The company bill and relevant sections and the impact on how the corporates will need to change the perception as the meagre 2% will amplify the manner in which rest 98% have been brought to kitty. The peep through will become a magnifying glass for the conduct of the management and by the time the report is out it will be too late for damage control. As the process owners CS will have to be vigilant and keepers of the brand equity.

More clarity will be possible once the act is published.

For further details and direction one has to wait for the rules as per the act.

The Sections:

Sec 134 (o) the details about the policy developed and implemented by the company on corporate social responsibility initiatives taken during the year; (p) in case of a listed company and every other public company

(ii) Concept of Corporate Social Responsibility is being introduced.

(iv) Additional Disclosure Norms:

(a) New disclosures like development and implementation of risk management policy, Corporate Social Responsibility Policy, manner of formal evaluation of performance of Board of directors and individual directors included in the Board report in addition to disclosures proposed in such report in the Companies Bill, 2009.

(b) Consolidation of accounts

Clause 135 — This new clause seeks to provide that every company having specified networth or turnover or net profit during any financial year shall constitute the Corporate Social Responsibility Committee of the Board. The composition of the committee shall be included in the Board’s Report. The Committee shall formulate policy including the activities specified in Schedule VII. The Board shall disclose the content of policy in its report and place on website, if any of the company. The clause further provides that the Board shall endeavour to ensure that at least two per cent of average net profits of the company made during three immediately preceding financial years shall be spent on such policy every year.

If the company fails to spend such amount the Board shall give in its report the reasons for not spending.

Item (a) of sub-clause (4) of clause 135 proposes to empower the Central Government to prescribe the manner of disclosure of contents of Corporate Social Responsibility Policy in the Board’s Report and on the company’s website.

First Proviso to sub-clause (1) of clause 136 proposes

(k) In case of Companies covered under section 135, amount of expenditure incurred on corporate social responsibility activities;

135. (1) Every company having net worth of rupees five hundred crore or more, or turnover of rupees one thousand crore or more or a net profit of rupees five crore or more during any financial year shall constitute a Corporate Social Responsibility Committee of the Board consisting of three or more directors, out of which at least one director shall be an independent director.

(2) The Board's report under sub-section (3) of section 134 shall disclose the composition of the Corporate Social Responsibility Committee.

(3) The Corporate Social Responsibility Committee shall,—

(a) Formulate and recommend to the Board, a Corporate Social Responsibility Policy which shall indicate the activities to be undertaken by the company as specified in Schedule VII; Corporate Social Responsibility.

(b) Recommend the amount of expenditure to be incurred on the activities referred to in clause (a); and

(c) Monitor the Corporate Social Responsibility Policy of the company from time to time.

(4) The Board of every company referred to in sub-section (1) shall,—

(a) after taking into account the recommendations made by the Corporate Social Responsibility Committee, approve the Corporate Social Responsibility Policy for the company and disclose contents of such Policy in its report and also place it on the company's website, if any, in such manner as may be prescribed; and

(b) Ensure that the activities as are included in Corporate Social Responsibility Policy of the company are undertaken by the company.

(5) The Board of every company referred to in sub-section (1), shall make every endeavour to ensure that the company spends, in every financial year, at least two per cent of the average net profits of the company made during the three immediately preceding financial years, in pursuance of its Corporate Social Responsibility Policy:

Provided that if the company fails to spend such amount, the Board shall, in its report made under clause (o) of sub-section (3) of section 134, specify the reasons for not spending

SCHEDULE VII

(See sections 135)

Activities which may be included by companies in their Corporate Social Responsibility Policies

Activities relating to:—

(i) Eradicating extreme hunger and poverty;

(ii) Promotion of education;

(iii) Promoting gender equality and empowering women;

(iv) Reducing child mortality and improving maternal health;

(v) Combating human immunodeficiency virus, acquired immune deficiency syndrome, malaria and other diseases;

(vi) Ensuring environmental sustainability;

(vii) Employment enhancing vocational skills;

(viii) Social business projects;

(ix) Contribution to the Prime Minister's National Relief Fund or any other fund set up by the Central Government or the State Governments for socioeconomic development and relief and funds for the welfare of the Scheduled Castes, the Scheduled Tribes, other backward classes, minorities and women; and

(x) such other matters as may be prescribed.

1. There are two modes of succession to the property of the deceased i.e. testamentary and intestate.

In the testamentary mode of succession, the property of the deceased devolves as per the wishes of the

deceased, expressed through the document called “will”. In the absence of the will or on the failure of

the will by not acceptance by the Court, the property devolves on the person/s in accordance with the

Law of succession. The nomination can be said to be a mode of testamentary succession, otherwise than

through the will, to the extent and/or in a cases where the nominee becomes absolute owner of the

property. The nomination is primarily a facility for quickly and easily realizing the property from

third parties, belonging to the deceased. It also helps the third parties of being relieved and

discharged from the liability by making the payment or transferring the property to the person nominated

by the deceased. It is a question thereafter, as to in which capacity the nominee holds the property.

1. There are two modes of succession to the property of the deceased i.e. testamentary and intestate.

In the testamentary mode of succession, the property of the deceased devolves as per the wishes of the

deceased, expressed through the document called “will”. In the absence of the will or on the failure of

the will by not acceptance by the Court, the property devolves on the person/s in accordance with the

Law of succession. The nomination can be said to be a mode of testamentary succession, otherwise than

through the will, to the extent and/or in a cases where the nominee becomes absolute owner of the

property. The nomination is primarily a facility for quickly and easily realizing the property from

third parties, belonging to the deceased. It also helps the third parties of being relieved and

discharged from the liability by making the payment or transferring the property to the person nominated

by the deceased. It is a question thereafter, as to in which capacity the nominee holds the property.

Nowadays, the financial market has become very attractive, yet complex and risky. Majority of the advisors are representing one

company or other but there remains nobody to represent “INVESTOR”, who gets totally misled and confused. So, I believe that instead

of PRODUCT PUSHING, the understanding of your investment needs is must.

For small investors, dealing in capital market is governed by 2 factors Greed and Fear. For High Net worth Individual Investors,

Stock Markets are a money minting machine also and sometimes a blaming tool where crores of rupees are washed way.

Nowadays, the financial market has become very attractive, yet complex and risky. Majority of the advisors are representing one

company or other but there remains nobody to represent “INVESTOR”, who gets totally misled and confused. So, I believe that instead

of PRODUCT PUSHING, the understanding of your investment needs is must.

For small investors, dealing in capital market is governed by 2 factors Greed and Fear. For High Net worth Individual Investors,

Stock Markets are a money minting machine also and sometimes a blaming tool where crores of rupees are washed way. Introduction: In today’s corporate world, the business has become very competitive and at the same time multifaceted also. Initially,

business organisations prefer to render different kinds of services or trade in different kind of goods through one business entity. At a

latter point, as the business grows; there is a substantial increase in the revenues and areas of operation in which the various services

are rendered or goods are traded. At this stage, many issues like revenues, expenses, human resources, plant, machinery and other resources

are allocable to each service rendered or goods traded by the Company. The management of such company, at this point of time, may take several

steps to reorganise the business which will aim at focusing on its core competency. There can also be a possibility that one of the businesses

is suffering from losses and hence eats up the revenues earned or profits generated by other businesses in the same business organisation.

One of the ways by which the reorganisation is done is by “disposing” of the business which has under developed or developed over a period of

time but not part of the core competency of the management of the company. This is just an example of reorganisation and there could many other

reasons and ways of reorganisation.

Introduction: In today’s corporate world, the business has become very competitive and at the same time multifaceted also. Initially,

business organisations prefer to render different kinds of services or trade in different kind of goods through one business entity. At a

latter point, as the business grows; there is a substantial increase in the revenues and areas of operation in which the various services

are rendered or goods are traded. At this stage, many issues like revenues, expenses, human resources, plant, machinery and other resources

are allocable to each service rendered or goods traded by the Company. The management of such company, at this point of time, may take several

steps to reorganise the business which will aim at focusing on its core competency. There can also be a possibility that one of the businesses

is suffering from losses and hence eats up the revenues earned or profits generated by other businesses in the same business organisation.

One of the ways by which the reorganisation is done is by “disposing” of the business which has under developed or developed over a period of

time but not part of the core competency of the management of the company. This is just an example of reorganisation and there could many other

reasons and ways of reorganisation.

It just takes a moment of STUPIDITY to cross the ethical lines whether its sports or corporate life. We have been feeling shame to which

is some of our cricketing stars have been alleged to have done the act of stupidity and see how the flourishing careers have gone to jail.

It just takes a moment of STUPIDITY to cross the ethical lines whether its sports or corporate life. We have been feeling shame to which

is some of our cricketing stars have been alleged to have done the act of stupidity and see how the flourishing careers have gone to jail.

Introduction

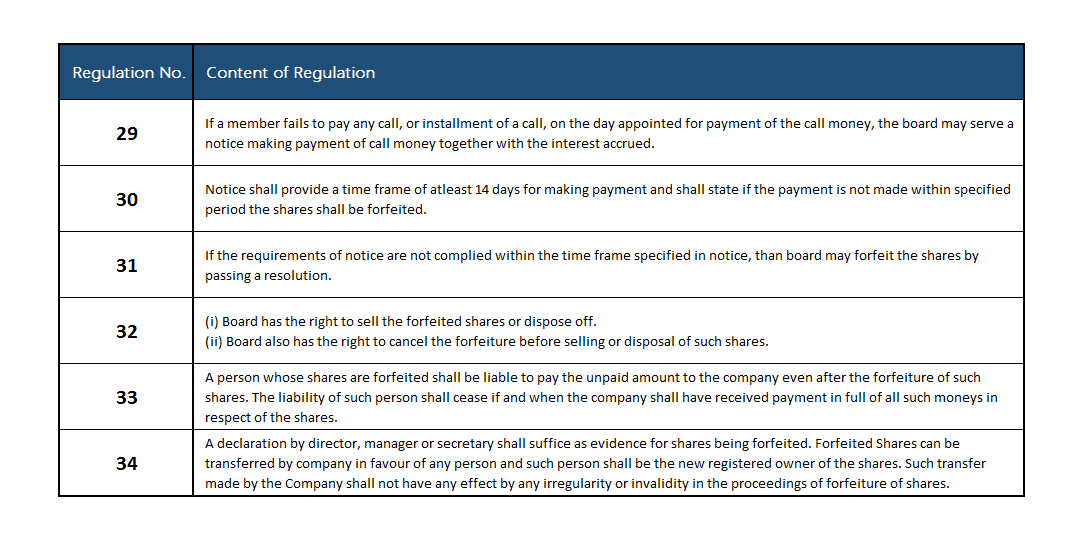

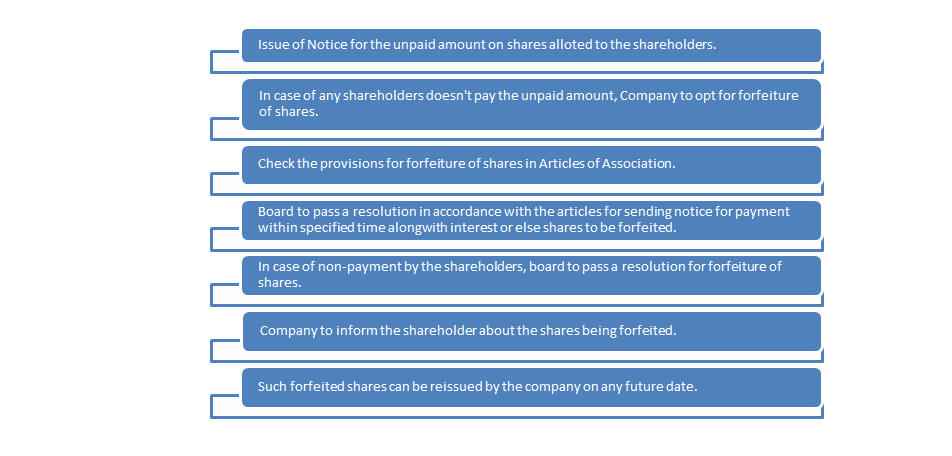

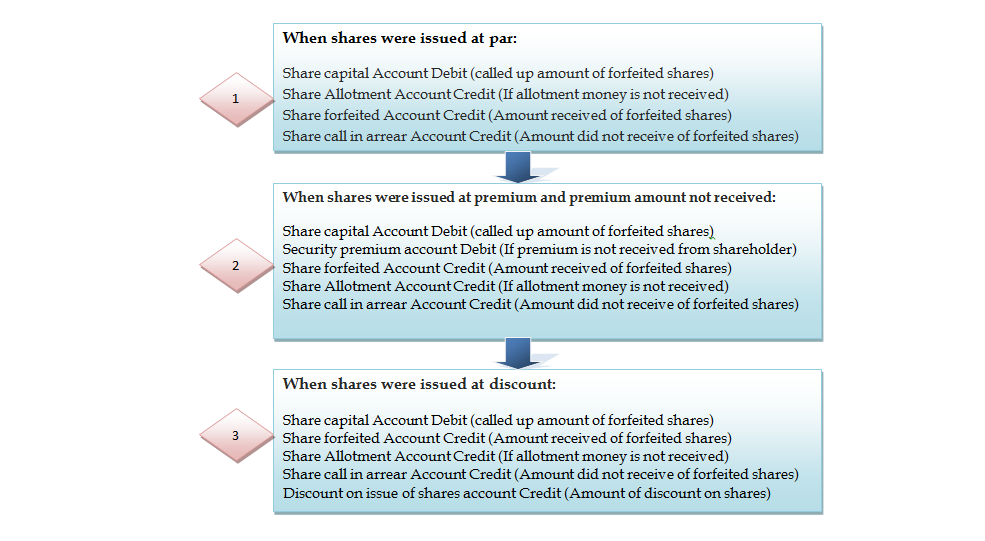

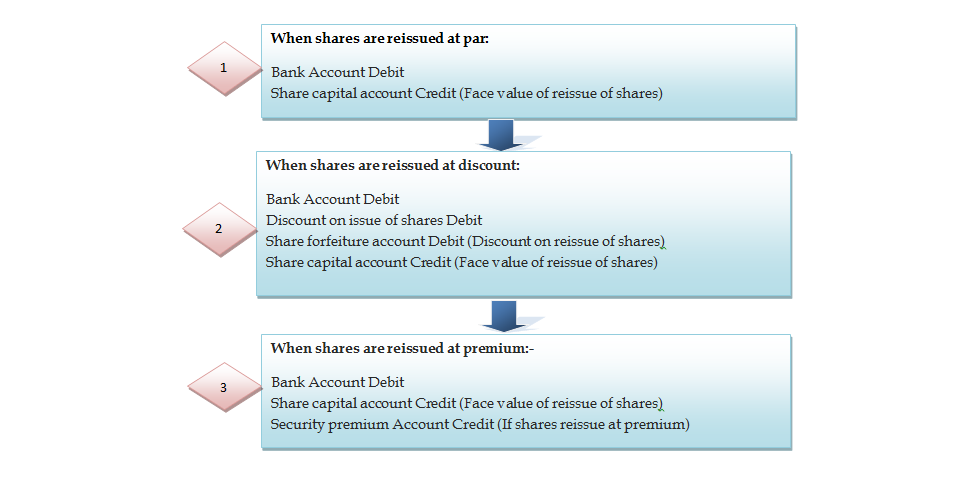

Introduction Why the Company forfeits the shares?

Why the Company forfeits the shares?

The JOBS (Jumpstart Our Business Startups) Act, signed by President Obama earlier in 2012, will dramatically change the nature of early-stage

funding. With buzz from fundraising websites like Kickstarter and Indiegogo, equity crowdfunding is gaining traction in US. Crowdfunding relies

on online intermediaries to communicate with the general public an idea for a business or product. Interested parties may then invest money in

the business or cause, providing financing in conjunction with other donors.

The JOBS (Jumpstart Our Business Startups) Act, signed by President Obama earlier in 2012, will dramatically change the nature of early-stage

funding. With buzz from fundraising websites like Kickstarter and Indiegogo, equity crowdfunding is gaining traction in US. Crowdfunding relies

on online intermediaries to communicate with the general public an idea for a business or product. Interested parties may then invest money in

the business or cause, providing financing in conjunction with other donors.

The business community in India is having rounds of heated discussions on the so called ‘Mandatory CSR’ while the world is waiting and watching

out for the outcomes as India will be the first country to (apparently) make Mandatory CSR . Everyone is waiting for clarity on ‘The New Game

Changer’ and contemplating how to apprehend ‘CSR in the Boardroom’! The clarity anxiously sought for is just round the corner once the bill is

passed by the Rajaya Sabha.

The business community in India is having rounds of heated discussions on the so called ‘Mandatory CSR’ while the world is waiting and watching

out for the outcomes as India will be the first country to (apparently) make Mandatory CSR . Everyone is waiting for clarity on ‘The New Game

Changer’ and contemplating how to apprehend ‘CSR in the Boardroom’! The clarity anxiously sought for is just round the corner once the bill is

passed by the Rajaya Sabha.

Somehow we need to keep an eye on our HDI and not get flabbergasted by euphoria of higher GDP and look within for improving HDI index as well. The picture and caption captures it all:

Somehow we need to keep an eye on our HDI and not get flabbergasted by euphoria of higher GDP and look within for improving HDI index as well. The picture and caption captures it all:

The findings of The Navigator:

The findings of The Navigator:

A) INTRODUCTION

A) INTRODUCTION

Shri Amardeep Singh Bhatia, Joint Secretary, MCA and Shri Anil Kumar Bhardwaj, Director (E-Governance) had series of interactions with stakeholders at various cities. One such meeting was held at Mumbai on 6th May, 2013 along with senior officers of Infosys to interact and find MCA-21 application related front office and back offices issues.

Shri Amardeep Singh Bhatia, Joint Secretary, MCA and Shri Anil Kumar Bhardwaj, Director (E-Governance) had series of interactions with stakeholders at various cities. One such meeting was held at Mumbai on 6th May, 2013 along with senior officers of Infosys to interact and find MCA-21 application related front office and back offices issues.

1) COMPROMISE AND ARRANGEMENT

1) COMPROMISE AND ARRANGEMENT