ICSI - WIRC FOCUS

Vol. XXX • No. 14 •Feb 2014

Chairman’s Blog

Dear friends

Dear friends

It takes me great pleasure to communicate with you all and wishing you all the best in professional and personal sphere

for the year ahead.

As you all are aware that next few years are going to be of great challenge as well as learning for our fraternity , with

the advent of the Companies Act,2013 (new act) and other proposed changes in the field of our work. This is the time for

us not only to outshine but also to create a imprint which should act as a benchmark for other professionals. Under the

new act at the one hand our fellow professionals who are in employment are recognized as Key Managerial Personnel (KMP)

on the other hand our fellow professionals who are in advisory and audit role will be required to conduct Secretarial

Audit and also provide advocacy. Also it is pertinent to note that under the new act the responsibility given to Company

Secretary Profession stems out from the faith of the legislators in our integrity and competency.

In view of the aforesaid we have to be equipped to face the challenge of not only learning the new laws but also enhancing

and polishing our skill sets including the soft skills.

In recognizing the needs of WIRC members on the aforesaid, I appeal you all to join the WIRC Professional Development

Programme which shall provide with a platform to learn and share.

As the institute is of all and we committee members are only facilitator and trustees thus, I request you all to provide

your inputs for the betterment of the Institute and benefiting the profession.

I, am very sure that with the dedication and efforts of the WIRC council members ,other members though not being in the

council , yet contributing immensely and the staff of WIRC, we shall providing our best to all.

I appeal to all our seniors to do guide us and provide their critical inputs for the betterment of the profession.

For the ensuing year at the backdrop of the aforesaid, the theme “Knowledge - Arise, Awake and Learn” seems most

appropriate.

”The capacity that transforms science into knowledge is the power of observation. Knowledge and Science come together and

result into a positive capacity i.e. capacity to explore. Knowledge is truth .The awareness of truth is acquisition of

knowledge, the utilization of knowledge for the purpose of growth and development is Science”. Dr.Aniruddha Joshi.

I seek support, suggestions and participation of all.

Editorial Board

Photo Feature

Banking Ombudsman

BANKING & OMBUDSMAN

BANKING & OMBUDSMAN

In this article, I want to introduce a term called ‘OMBUDSMAN’ insight to the rights conferred under the BANKING OMBUDSMAN ACT.

OMBUDSMAN - the word has been used for several centuries to describe a man who protected or represented the rights of another.

Webster’s dictionary defines ‘ombudsman’ as a public official appointed to investigate citizens’ complaints against government agencies or officials that may be infringing on the rights of individuals. The Reserve Bank of India brought the Banking Ombudsman Scheme in 1995. It has been time and again amended.

What is Banking Ombudsman ?

The Banking Ombudsman is a senior official, appointed by the Reserve Bank of India to address grievances and complaints from customers, regarding deficiencies in banking services. It covers all kinds of banks – PSU Banks, Private banks, Rural banks and co-operative banks. Even though, it was originally setup in 1995, there were major revisions in 2006 covering transactions related to complaints of ATM cards, debit cards and credit cards, deduction of service charges by banks without prior intimation, unfair practices of banks and non-compliance by direct sales agents (DSA) of banks for services promised while opening an account etc. It was last amended in Feb, 2009 to cover deficiencies arising out of internet banking too. Today, the Banking Ombudsman covers almost all kind of complaints for banking services.

THE SALIENT FEATURES OF BANKING OMBUDSMAN

• The Reserve Bank of India has framed Banking Ombudsman Scheme, 2002 under Section 35A of the Banking Regulation Act, 1949 for resolution of complaints relating to provision of banking services and facilitate the satisfaction or settlement of such complaint.

• Ombudsman attempts to resolve the customer complaints relating to provision of banking services and other specified matters by settlement thru agreement, recommendation for settlement and/or passing an Award.

• It provides inexpensive, hassle-free process of redressing complaints related to banking services with a disposal time ranging from as less as one month to approximately 18 months.

• A Customer of any Scheduled Commercial Bank (Including Foreign Bank), scheduled primary co- operative banks AND regional Rural Bank can approach Banking Ombudsman of the concerned area of Operation for redressal of his/her complaint.

GROUNDS OF COMPLAINT

• A complaint on any one of the following grounds alleging deficiency in banking service may be filed with the Banking Ombudsman having jurisdiction:

a. Non-payment/inordinate delay in the payment or collection of cheques, drafts, bills etc.;

b. Non-acceptance, without sufficient cause, of small denomination notes tendered for any purpose, and for charging of commission in respect thereof;

c. Non-issue of drafts to customers and others;

d. Non-adherence to prescribed working hours by branches;

e. Failure to honour guarantee/letter of credit commitments by banks;

f. Claims in respect of unauthorised or fraudulent withdrawals from deposit accounts, or fraudulent encashment of a cheque or a bank draft etc.,

g. Complaints pertaining to the operations in any savings, current or any other account maintained with a bank, such as delays, non-credit of proceeds to par ties’ accounts, non-payment of deposit or non- observance of the Reserve Bank directives, if any, applicable to rate of interest on deposits.

h. Complaints from exporters in India such as delays in receipt of export proceeds, handling of export bills, collection of bills etc., provided the said complaints pertain to the bank’s operations in India;

i. Complaints from Non-Resident Indians having accounts in India in relation to their remittances from abroad, deposits and other bank-related matters.

j. Complaints pertaining to refusal to open deposit accounts without any valid reason for refusal and

k. Any other matter relating to the violation of the directives issued by the Reserve Bank in relation to banking service.

• Complaints concerning loans and advances only in so far as they relate to the following may also be filed with the Banking Ombudsman having the jurisdiction:

a. Non-observance of Reserve Bank Directives on interest

rates;

b. Delays in sanction, disbursement or non- observance of prescribed time schedule for disposal of loan applications;

c. Non-acceptance of application for loans without furnishing valid reasons to the applicant;and

d. Non-observance of any other directions or instructions of the Reserve Bank, as may be specified by the Reserve Bank for this purpose,from time to time.

• PROCEDURE OF FILING COMPLAINT

There are two ways of filing complain Online & Offline

Online Complaint : You can complain to Banking ombudsman online by filling up the form here . Once you fill up the form , you can also upload your proofs like bank rejection letter, banks reply or anything else (it has to be PDF or TXT format only)

Offline Complaint : You can also complain in offline mode to Banking Ombudsman)

1. The complaint shall be in writing duly signed by the complainant or his authorised representative (other than an advocate) in a form specified in the Scheme.

2. It should contain detail facts giving rise to the complaint supported by documents, if any, that are desired to be relied upon by the complainant, the nature and extent of the loss caused to the complainant, the relief sought from the Banking Ombudsman.

3. No complaint to the Banking Ombudsman shall lie unless:

(a) The complainant had before making a complaint to the Banking Ombudsman not made a written representation to the bank named in the complaint;

(b) The complaint is made not later than one year after the cause of action has arisen;

(c) The complaint is not in respect of the same subject matter which was settled through the Office of the Banking Ombudsman in any previous proceedings;

(d) The complaint does not pertain to the same subject matter, for which any proceedings before any court, tribunal or arbitrator or any other forum is pending or a decree or Award or a final order has already been passed by any such competent court, tribunal, arbitrator or forum;

(e) The complaint is not frivolous or vexatious in nature.

(f) The complainant to provide his/her contact information, name and address of the bank against which you are lodging the complaint, documentary evidence and the compensation you need. Once you have filled up the form, you can send it to the Banking Ombudsman address which comes under your jurisdiction the bank branch resides

4. The Banking Ombudsman can also entertain a complaint provided he is satisfied with the documentary evidence produced before him by the complainant that;

a. The interests of the complainant has suffered adversely on account of lapse or inaction on the part of the bank or due to connivance on the part of any employee of the bank facilitating the unauthorised or fraudulent withdrawal from the bank account of the complainant; or encashment, as the case may be;

b. No interim injunction or stay order or any other direction, either restraining, the bank from making payment of the amount of claim as made by the complainant or the complainant from agitating his claim simultaneously, before any other forum, has been passed by any court, tribunal or arbitrator or any other such forum before whom the claim of the complainant is pending adjudication and

c. In the opinion of the Banking Ombudsman the disposal of such pending proceeding is likely to take longer time.

AWARD OF OMBUDSMAN:

• The Banking Ombudsman cannot grant compensation more than the losses suffered by the complainant. He can grant compensation not exceeding Rs.10 lakhs.

• His Award is binding on the bank against which it is passed provided the complainant furnishes within 15 days a letter of acceptance of the award in full and final settlement of his claim.

• If award is against the complainant he is required to furnish indemnity. If the complainant fails to honour the indemnity the bank can approach a court of law.

• There is provision of review of the Award of the Banking Ombudsman before the Dy. Governor In-charge of Rural Planning & Credit Department.

OMBUDSMAN IN SECURITIES MARKET:

The Joint Parliament Committee on Stock Market Scam, in its report recommended the concept of Ombudsman for the Stock market. Subsequently,

the SEBI (Ombudsman) Regulations, 2003 was notified on 21.8.2003. The SEBI Ombudsman can be understood as an office (person) appointed to

redress investors’ complaints against a listed company, company intending to get its securities listed or a capital market intermediary,

which is more properly defined in the SEBI Act. The office of the SEBI Ombudsman is located at Head Office of SEBI.

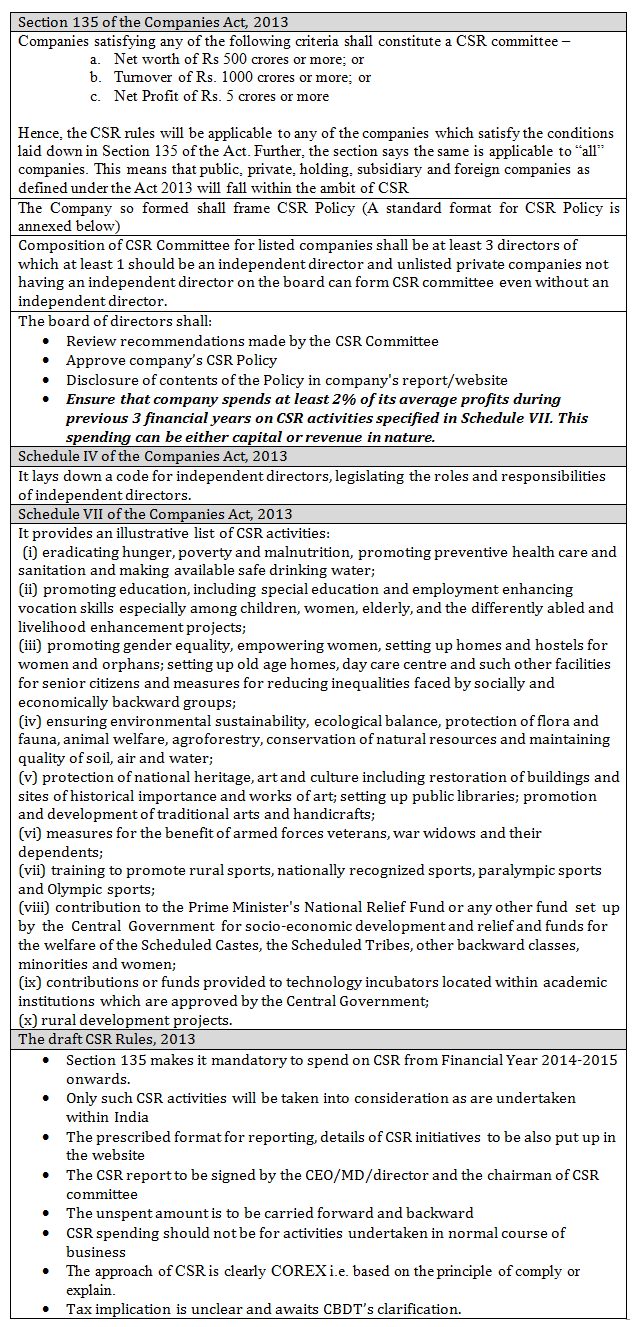

Mandating CSR: Will spending-based measure lead to “responsible” corporate citizens?

Introduction

Introduction

The corporate sector once considered as a catalyst to the environmental development has buried its very essence under the pile of scams, tainting its own image. Where corporate have continuously exploited the environment, neglecting their responsibilities towards it, the society and environment is now spilling over. This has made corporate all over the world to realize the need of having a good Corporate Social Responsibility policy and the nations earlier racing in economic terms are now adding a new course to their race – “good governance and social responsibility”. India is making all attempts to lead in this race, while most of the nations are still mandating disclosures India has taken a step forward to spend towards CSR activities. Notifying Section 135 of the Companies Act 2013 and Companies (Corporate Social Responsibility Policy) Rules, 2014 w.e.f. 01.04.14 India has become the world’s first country to formally mandate companies of certain size to spend a percentage of their profits on CSR activities. Is this a correct move? Is CSR only about spending? Where will this spending ultimately go to? Will spending-based measure lead to “responsible” corporate citizens? - are some of the unanswered questions.

CSR spending mandated in India

In1990 only few companies in the world had CSR policy since then the concept of CSR has skyrocketed. Although India has been rather slow in promoting it over these years but now with the advent of Companies Act 2013 its pace have left all behind. While all the other countries are still making and amending laws on disclosure requirements of CSR, India has made a move towards mandatory CSR spending with the introduction of Section 135 in the Companies Act, 2013.

Will mandatory CSR spending result in “cheque-book CSR”: Views on mandating CSR in India

Mandatory CSR has been a buzzing word these days in India and also considered as one of the major highlights of the Companies Act, 2013. People all around have given their views on this issue. It seems that mixed reactions are floating in the environment. Where some in the corporate sector are worried that making CSR spending mandatory would lead to what is informally referred to as “cheque-book CSR”. Others, while sounding positive about a law that encourages companies to act responsibly, find the list and scope of activities too small to comprehensively correspond to what entails a company’s responsibilities towards the society.

Business sayings:-

Plato said “Good people do not need laws to tell them to act responsibly, while bad people will find a way around the laws.”

Michael Porter, professor at Harvard Business School and a leading expert on competitiveness strategy, said- “Businesses should address social problems through profitable business models rather than through mandatory corporate social responsibility (CSR) activities”. He also said that businesses, through their strategic thinking and value creation, will be critical to India’s economic progress in the coming years. Mandatory CSR activities may not create an impact as businesses may just look at allocating money for such activities rather than seeking optimal ways for addressing social issues.

Montek Singh Ahluwalia, an Indian economist said – “mandatory CSR amounts to privatising taxation”. He is of the view that having corporate tax in the country, spending another 2% is not viable. It is better to raise corporate tax to 32% rather than using CSR spending as a veil to corporate tax.

Wipro Chairman Azim Premji protested on behalf of the India Inc “the people on the board are sufficiently conscious regarding the matter and corporate social responsibility cannot be created with statutory requirements.”

According to J. J. Irani, former director of Tata Sons, who led a panel to draft the Bill in 2005, understanding the Indian mentality had well said that- “People will find ways to skirt anything that is mandated. My objection is that the percentage is wrong, because profits fluctuate. So, should a company spend more on CSR when it is making good profits, and spend nothing when down in the dumps?”

A Hawaii university scholar calls India’s proposed mandatory CSR spending—“An anomaly indeed in the world of CSR”. The Indian government has made an attempt to bridge the gap between economic and social development wherein it shall satisfy voters by forcing companies to promote social welfare, and please companies by avoiding additional taxes while allowing them to benefit from the autonomy of choosing how and where they will support social goods.

On the other hand some writers observe that there are serious limitations to regulatory law that corporate social responsibility is poised to overcome. Where regulation is always reactive it is time for corporations to take a proactive step wherein it shall not only prevent negative externalities, but they can furnish positive externalities as well.

Provisions of Companies Act, 2013 and Companies (Corporate Social Responsibility Policy) Rules, 2014

Are we ready to implement the mandatory CSR sending or is it a rush?

Mandatory Business Responsibility Report (BRR) for top 100 BSE Companies

Top 100 listed companies in India based on Bombay Stock Exchange (BSE) rankings on 31st March 2011 have been mandated by Securities and Exchange Board of India (SEBI) to publish a yearly Business Responsibility Report (BRR) separately or along with their annual reports.

For FY 12-13, based on the data collected for 84 companies if 2% of average profits was to be considered as base for CSR spending, the spending should have been 4276 crores but actually the spending was only Rs 2724 crore. This reflects that there is wide gap to be filled in and lots of more effort is required on the part of Indian corporate.

Further CSR now being mandatory still BRR has to be produced by above mentioned companies but we may expect that the Listing Agreement may be revised in line with the provisions of the Act soon and therefore, the BRR may be avoided. However, we will need to take a view after seeing the revised form of listing agreement.

Need for more directors:

Although CSR is essential for overall development of society and Indian government has taken the step of implementing it but has it taken care of the series of events that will actually make its implementation possible. Sources reflect that approximately 10000 companies will have to comply with the requirement once CSR is mandated. Considering at least 3 directors on board and 1 women director in each such company, around 30000 individuals will be needed for board of directors out of which at least 10000 should be women.

Estimated spending:

While most of the other countries are still busy making laws and regulations on disclosure requirements, India is way ahead inching towards spending a part of its earning on CSR. An estimated spending of about Rs 100 billion per year has been made to which around 5000-8000 companies are entitled to contribute.

Impact of shifting focus from efforts to spending:

CSR should be integrated with the traditional business strategies and just mandating its requirement is not a solution towards social responsibility. The crux of CSR is doing and not merely spending. The ultimate objective of CSR can be obtained only when efforts are made by all in the correct direction. Hence doing may involve spending but spending is not the end of CSR policy. It is just a mean to achieve the end - which is effort towards implementing CSR policy. By simply mandating spending, CSR may eventually end up into politicians forcing companies to donate to the Chief Minister’s relief fund.

Sustainability part is completely missing:

Where most countries in the world have stressed companies to focus on sustainable development so that optimum utilisation of available resources can be made with minimal wastages India has not captured this area in its agenda at all. Unfortunately, where companies in other nations are required to explain, whether their economic activities in any way cause damage to the environment, and their initiatives for sustainable development, by way of performing environmental cost and benefit analysis and environmental impact analysis to ensure that the coming generation also have suitable resources to satisfy their needs the same is completing missing in India.

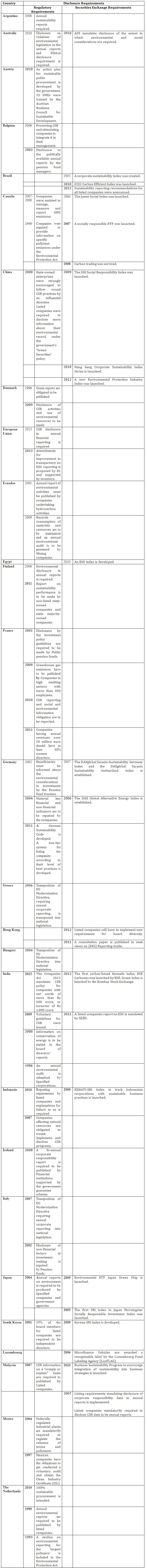

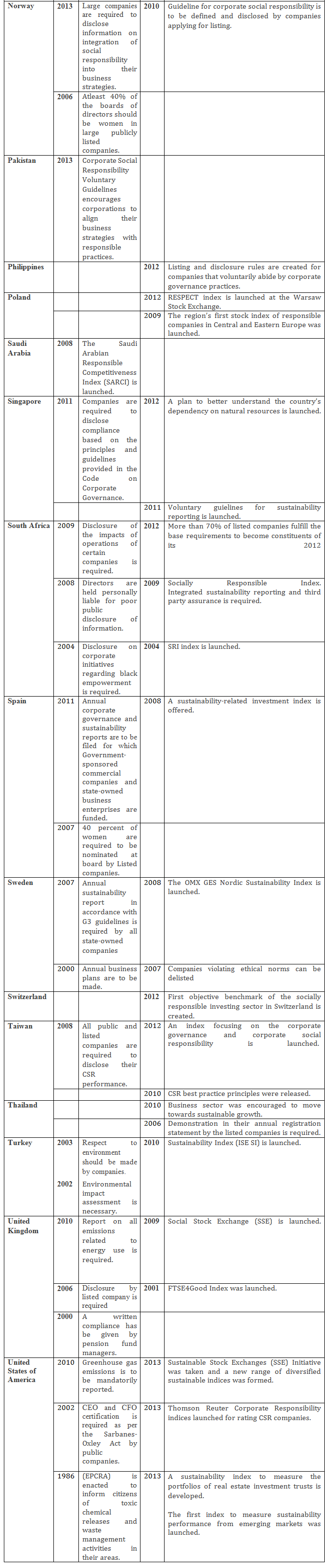

International comparative table on CSR

CSR is a not a new concept, it is an old dish served on a new plate. CSR reporting and disclosure requirement is mandated worldwide. The table below throws light on the evolution and development of CSR country-wise containing both the regulatory as well as stock exchange disclosure requirements. It clearly brings out the anomaly in the world of CSR- where almost all the countries have regularly come up with new CSR reporting requirements, India has additionally mandated spending on CSR activities: way ahead the principle of comply or explain.

Conclusion

More and more laws and regulations are also accompanied by scams after scams- be it the Enron’s case in U.S or the Satyam and Sahara

case in India. Unfortunately, in India if there are 100 of law makers there are 1000s of law breakers too. So the major question to be

answered is whether there is a lack of law or lacuna in implementation of law – that has led to mandating CSR. CSR is a value based and

externally focused approach and being such a soft nature concept it shall be voluntary and not mandatory. It is a responsibility that

should come from within– being part of the society what is it that we can do to make it a better place. In my view, answer to all the

above asked questions is one - Mandating CSR requirement is not the solution to the problem. It is not what will lead to good corporate

citizens rather creating awareness for the need and benefit of CSR is the ultimate solution. However, the Indian Government being aware

of all the sayings about CSR has still notified the section and it is too early to say whether the step taken is correct or not as the

use or misuse of the CSR policy will be determined by the intent of the companies.

RD Column

Introduction and some routine issues

Dear friends,

Dear friends,

Recently, the Ministry has issued Circular No.1/2014 dated 15-1-2014 in the matter of report of filing of the Regional

Director under Section 394A of the Companies Act, 1956 with regard to Petitions filed by various companies under Section

391-394 of the Companies Act, 1956. Copy of petitions served upon the Regional Director on behalf of the Central Government,

as the powers under this Section have been delegated to the Regional Director to file representations on behalf of the Central

Government.

In a recent matter, the Income Tax Department has filed an intervention application in some petition and the Hon’ble High

Court has observed that they have no locus standi and they can represent their cause only through the Regional Director.

Keeping in mind such developments in various matters, the Ministry issued this Circular with the direction that Regional

Director shall invite specific comments from the Income Tax Department, giving 15 days time and in case, no representation

is received from the Income Tax Department within the said period, then it will be presumed that they have no objection and

the Regional Director can file his Affidavit accordingly. Provisions have been made in the said Circular for seeking feed

back from any other sectoral regulator, depending upon case to case.

Keeping in mind the quantum of work being handled by the office of the Regional Director (WR), relating to Merger

/Amalgamation/Compromise, the Hon’ble High Court of Mumbai has passed a judgment in the matter of 53 pending petitions,

framing certain guidelines and time schedule to ensure that the reply from the Regional Director office is filed in a time

bound manner in these petitions as well as petitions to be filed in future also. So far as collection of information from

the Income Tax Department is concerned, the Hon’ble High Court has observed that in certain cases there is possibility that

the Income Tax Department may require more time and further observed that when the time is required for sufficient reasons,

it will be for the Income Tax Department to apply for extension, explaining the reasons and the request will be considered on

case to case basis. It was further ordered that to ensure that the notice from the Regional Director is sent to the correct

Assessing Officer, in all petitions and applications, as also in the minutes of the order, particulars of that Assessing

Officer, including his present designation, circle and address shall be specifically mentioned. The Regional Director is

not expected to re-verify this.

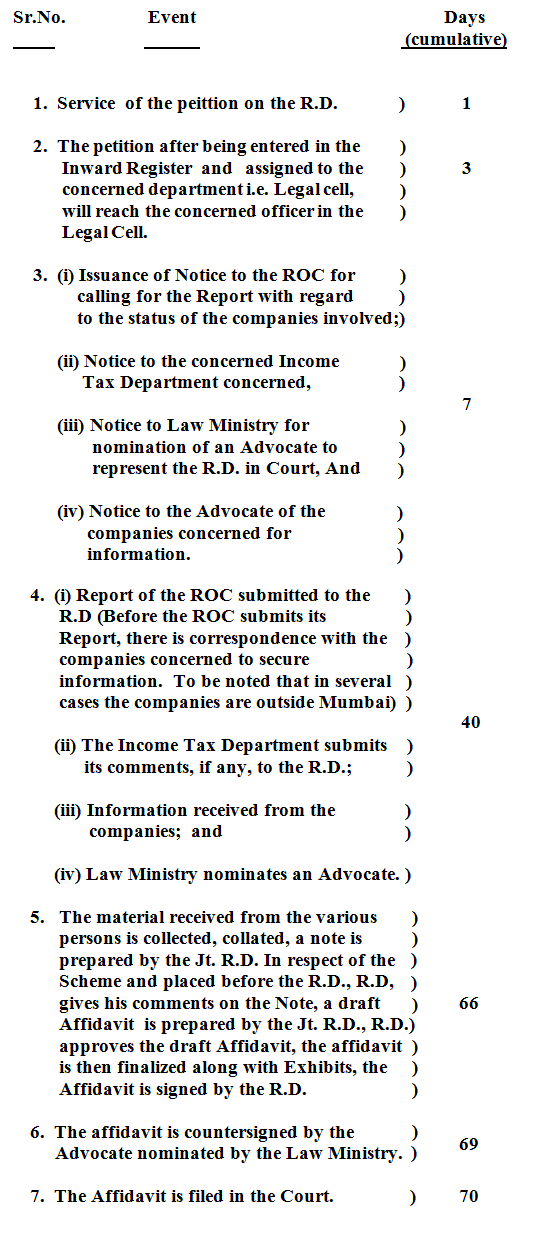

The Hon’ble High Court has fixed time frame of 70 days for filing the reply by the Regional Director and has laid down

procedure to be followed for the filing of petition under section 391-394 of the Act and the same is

reproduced as under:

All the concerned Professionals who are dealing with such matters are advised to take note of the comments of the Circular

as well as orders of the Hon’ble high Court for strict compliance and advise their clients accordingly.

(K.L.KAMBOJ)

REGIONAL DIRECTOR,

WESTER REGION,

MUMBAI

WIRC Advertisements/Announcements

Case Laws at a Glance

A Bird’s Eye View: Recent judgements on Company Law

1) TRANSFER OF SHARES

1) TRANSFER OF SHARES

Power To Refuse Registration And Appeal Against Refusal

Appellant was initial shareholder along with his father ‘S’ and sister ‘M’ in respondent company. Later, in 1993

pursuant to a family settlement appellant gave up his shares in company and resigns from directorship and was given

exclusive ownership of partnership firm carrying business of bag closing machines. On death of appellant’s mother in

1995 and his father in 2001, their shares in company were transferred in name of ‘M’ and her son. Appellant in year

2009 filed a company petition raising a plea that he was owner of 52.5 percent of total shares of company and his

name did not appear in register of member. CLB by impugned order dismissed petition holding that there are inordinate

and unexplained delay of 16 years on part of appellant in seeking relief and settlement entered in life time of ‘S’

could not be challenged. Long silent of appellant for a period of 15-16 years was in conformity and consistent with

family settlement and he had consciously given up his shares. Appellant was, thus, guilty of laches or unreasonable

delay in asserting in his claim. From records it was evident that appellant was not shareholder of company and, therefore

appeal was to be dismissed. – DINESH SUD V. STITCHWELL QUALITEX (P.) LTD. [2013] 122 SCL 268 [DELHI].

2) ANNUAL ACCOUNTS

There is no requirement laid down in section 210 nor there is any necessity that the Company must take a decision to extend

the financial year before the financial year or period by which the financial year is sought to be extended expire. – Section

210 - DINESH SAINI V. UNION OF INDIA. [2014] 118 CLA 86 [DELHI].

3) RECTIFICATION OF REGISTER OF MEMBER

Petitioner cannot to be said to conceal or suppress facts of which he is not aware to hold that he has come to court with

unclean hands. – Sections 111, 111A and 108 - GAURISHANKAR NEEKLANTH KALYANI V. SULOUCHANA NEEKLANTH KALYANI. [2014] 118

CLA 63 [CLB- MUMBAI].

4) OPPRESSION AND MISMANAGEMENT

Charge of misappropriation of funds of Company cannot be proved when statement of accounts is signed by the petitioner and

respondent.- BHARAT SAVLA V. HIRAK PLASTICS (P.) LIMITED. [2014] 118 CLA 136 [CLB- MUMBAI].

5) WINDING UP

By operation of sub-section (2) of section 441, presentation of petition for winding up has to be construed as the date

on which the proceedings are deemed to have commenced. – Sections 441, 529 and 537 read with, section 19 of recovery of

Debt due to Banks and Financial Institution Act, 1993. – OFFICIAL LIQUIDATOR OF KRITIKA RUBBER INDUSTRIES (P.) LTD. V.

CANARA BANK [2014] 118 CLA 89 (KAR.).

6) EXTRAORDINARY GENERAL MEETING

Power of the Company Law Board to direct convening of extraordinary general meeting under section 186 can only be invoked

when company fails to convene it under section 169 – Sections 186 read with section 169 – AMRITA MEDIA (P.) LTD. V.

AMRITA BAZAR PATRIKA (P.) LTD. [2013] 113 CLA 144 (CLB - KOLKATA).

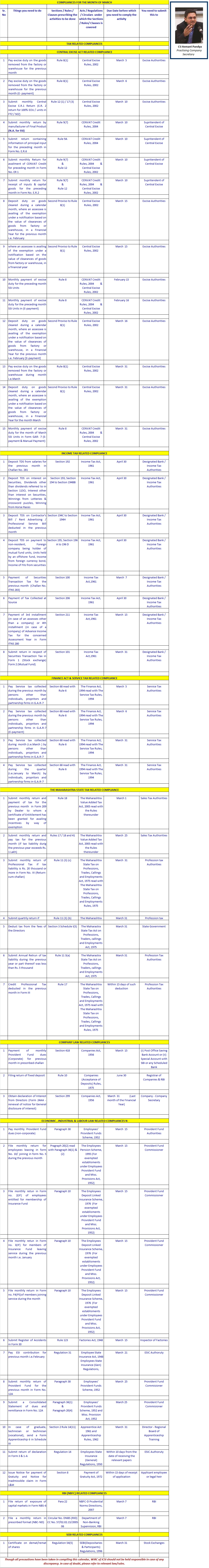

Monthly Compliance Calendar

Smile Please / Cartoon

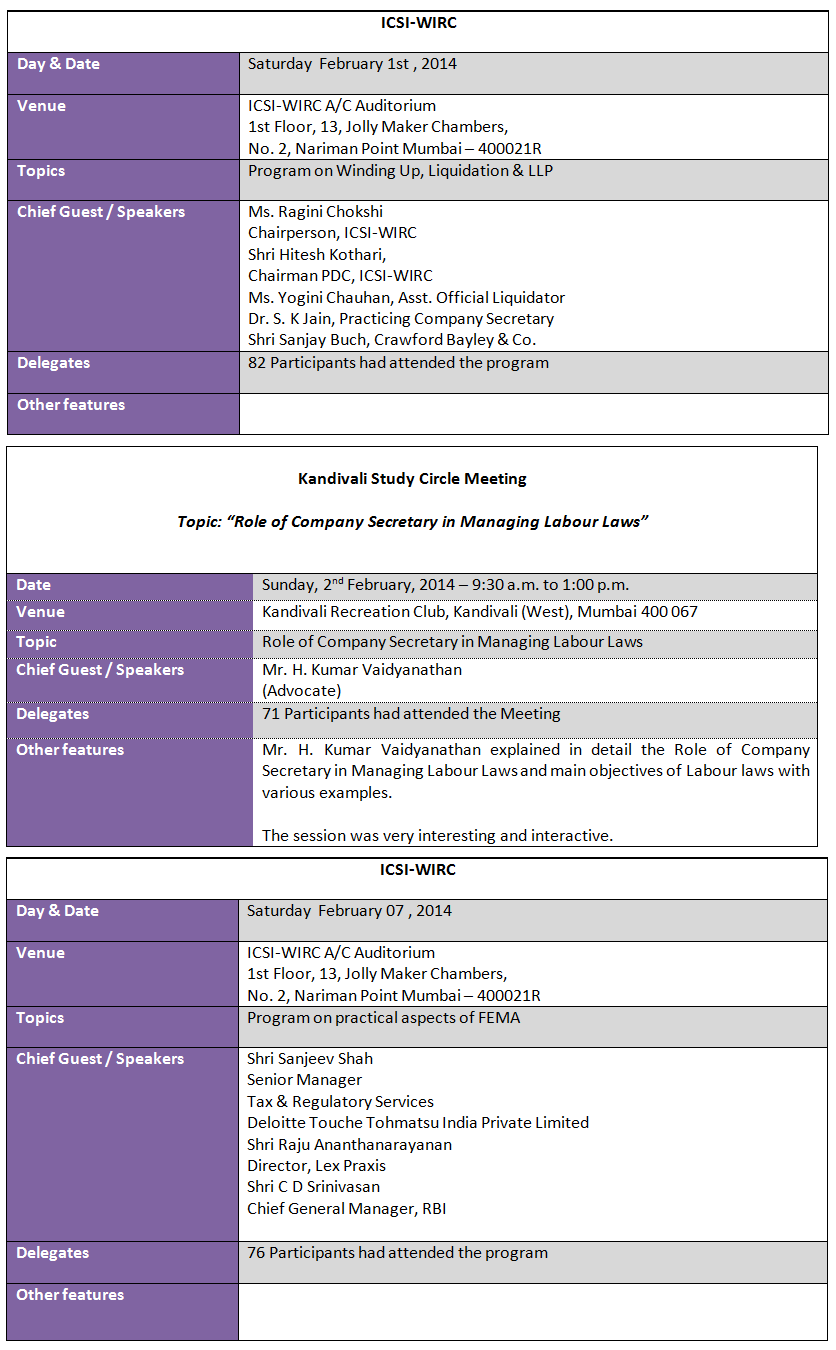

WIRC News

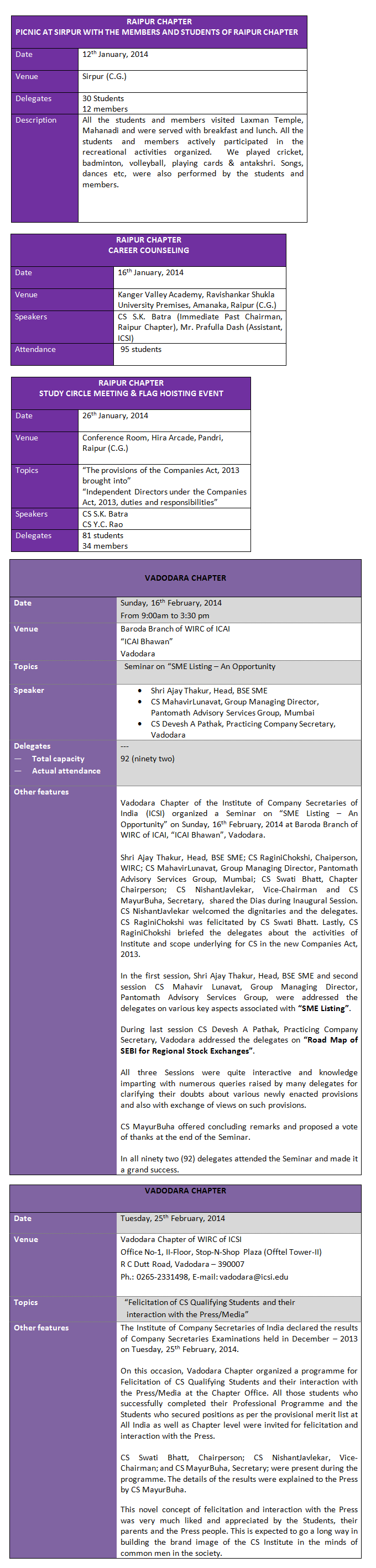

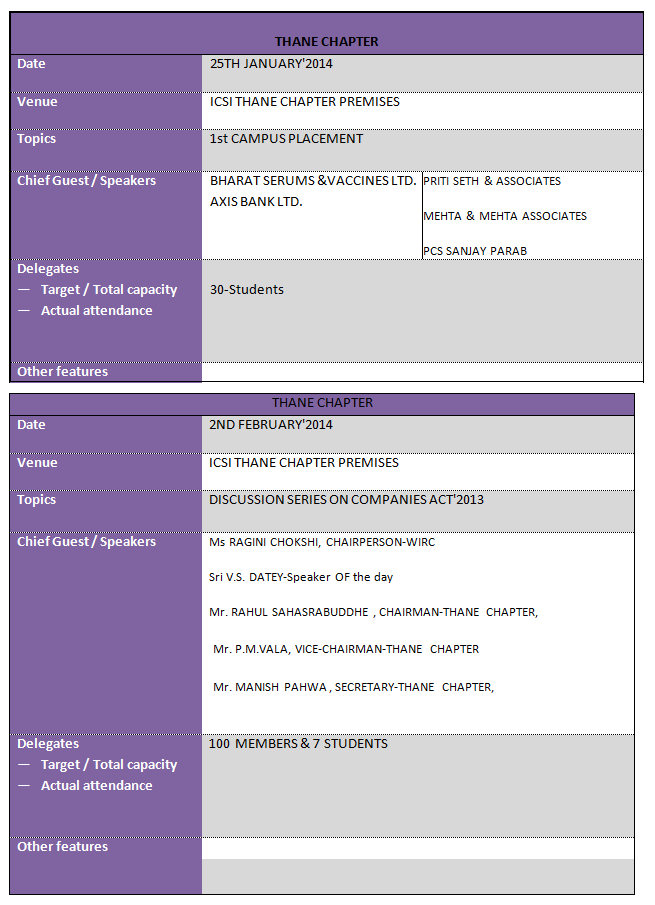

Chapter News

Executive Development Programme 14th Batch at Hira Raman Hall

The Ahmedabad Chapter arranged 14th EDP- Executive Development Programme at Hira Raman Hall, Near GB Shah College,

Near BSNL Tower, Vasna, Ahmedabad, from Tuesday, 21st/January to Thursday, 30th/January, 2014, from 10am to 05pm.

The EDP training was inaugurated by CS Hitesh Buch – Immediate Past Chairman WIRC and CS Rajesh Tarpara – Chairman

Ahmedabad Chapter of WIRC of ICSI and CS Naresh Senani – Co-ordiator for EDP 14th Batch.

The session started with general instructions and briefing of the programme to all the 133 participants. The sessions

were combination of both soft skill topics and CS technical topics taken by CS Rutul Shukla on topic “RBI / ROC”,

“Interpersonal Skills’ by Mr. Jwalant Bhavsar, ‘Indian / Global Economy’ by Mr. Tekpal Singh, ‘Capital Market’ by

CA Neha Shah, ‘Personality Development’ by Mr. Pabitra Ranjan, ‘CLB, NCLT/NCLAT’ by CS Arvind Gaudana, ‘International

Taxation’ CA Prakash Udeshi, ‘Life Skills’ by Mr. Uday Dholakia, ‘Drafting of Minutes, Notices and Resolutions’ by

CS Anjali Bothra, ‘Communication Skills’ by Mr. Ankit Joshipura, ‘Companies Act 2013’ by CS Manoj Hurkat, ‘Team Spirit’

by Mr. Rakesh Patel, ‘Stock Exchange/SEBI’ by CS Shyamal Trivedi, ‘CCI’ by Advocate Udayan Vyas, ‘Negotiation skills’

by Mr. Deepak Makhwana, ‘Decision making skills’ by Mr. Gaurav Vatsa, ‘Interview Techniques’ by Ms. Kruti Jadawala,

Computer Literacy’ by CS Rajesh Tarapara and ‘Significance of Training and Code of conduct’ by CS Rohit Dudhela.

The Valedictory session commenced with the presence of CS Chetan Patel – Chairman TEFC Ahmedabad Chapter of WIRC

of ICSI and CS Naresh Senani – Co-ordinator EDP 14th Batch. The training concluded with the views of participants

on the arrangements of EDP training, EDP topics and Feedback on the lectures taken by various faculties along with

distribution of EDP Certificates to all participants.

6th National Conference on Companies Act – 2013

In view of the emerging issues and key developments, ASSOCHAM in association with ICSI as Academic Partner, organized

full day 06th National Conference on “Companies Act – 2013 - New Rules of the Game” on Friday, 14th, 2014 in Ahmedabad

for mounting larger awareness among the corporates.

The first technical session was taken by Shri S. K. Agarwal, Regional Director, Ministry of Corporate Affairs on topic

Corporate Social Responsibility, CS Ashish Doshi, Vice Chairman, Western India Regional Council of ICSI deliberated

lecture on topic Overview of New Companies Act, CS Chirag Shah, Past Chairman of Ahmedabad Chapter of WIRC of ICSI and

Practising Company Secretary spoke on topic Corporate Governance, Independent Directors.

The second technical session begin in valuable presence of Chairperson: Shri S. N. Misra, ROC – Ahmedabad, Ministry

of Corporate Affairs. The session of second technical session was taken by Shri Hitesh Buch, Proprietor Hitesh Buch

& Associates on subject Empowered SFIO, Shri Vishal Gada, Partner, KPMG in India deliberated lecture on M & A related

issues under the Act, Shri Sukrut Mehta – Director, KPMG in India on Auditors spoke on Accounting & Auditing Standards

and Ms. Silpi Thapar, Proprietor, Silpi Thapar & Associates spoke on topic Class Action Suits.

The seminar attended with participation of thirteen CS Members with eligibility of 04 PCH.

69th Student Induction Program

The Ahmedabad Chapter of WIRC of ICSI organized 69th Student Induction Program from Wednesday, 05th February to

Wednesday, 12th February, 2014, from 10 am to 05 pm, at Hiraraman Hall, Aagam Shah Complex, Opp. Vasna Bus Stand,

Nr. GB Shah College & BSNL Tower, Vasna, Ahmedabad. The inauguration session was graced with the presence of CS

Rajesh Tarpara – Chairman, & CS Chetan Patel, Chairman, TEFC Committee, Ahmedabad Chapter of WIRC of ICSI. CS

Rajesh Tarpara addressed the participants during the inaugural session and welcomed the students.

The galaxy of faculties like CS Chetan Patel, Mr. Jwalant Bhavsar, Mr. Siddharth Bhandari, Mr. Deepak Makhwana, CS

Rohit Dudhela, CS Deepa Methwani, CS Jaladhi Shukla, Mr. Mitesh Mehta, Mr. Gaurav Vatsa, Mr. Pabitra Ranjan, Mr.

Ankit Joshipura, Ms. Kruti Jadawala, Mr. Uday Dholakia and Mr. Rakesh Patel deliberated lecture on various topics

as per training guidelines of the ICSI during the SIP Trainig. The participants cherished and benefited with the

knowledge of the speakers and trainers.

The Valedictory Session was held with gracious presence of CS Tushar Shah – Member TEFC Sub Committee Ahmedabad

Chapter.

The certificates were distributed to all SIP participants during the Valedictory session. The seven days training

was successful with great learning and fun. The total strength of the SIP batch was 138 participants.

70th Student Induction Program

The Ahmedabad Chapter of WIRC of ICSI organized 70th Student Induction Program from Tuesday, 18th February to Tuesday,

25th February, 2014, from 10 am to 05 pm, at Hiraraman Hall, Aagam Shah Complex, Opp. Vasna Bus Stand, Nr. GB Shah

College & BSNL Tower, Vasna, Ahmedabad. The inauguration session was graced with the presence of CS Rutul Shukla –

Secretary, & CS Tushar Shah, Member TEFC Sub Committee, Ahmedabad Chapter of WIRC of ICSI. The dignitaries welcomed

the students and extended their gratitude for choosing Ahmedabad Chpater for SIP training.

The galaxy of faculties like CS Chetan Patel, Mr. Jwalant Bhavsar, Mr. Siddharth Bhandari, Mr. Deepak Makhwana,

CS Rohit Dudhela, CS Deepa Methwani, Ms. Rakhi Dutta, Mr. Mitesh Mehta, Mr. Gaurav Vatsa, Mr. Pabitra Ranjan, Mr.

Ankit Joshipura, Ms. Kruti Jadawala, Mr. Uday Dholakia and Mr. Rakesh Patel deliberated lecture on various topics

as per training guidelines of the ICSI druing the SIP training. The participants cherished and benefited with the

knowledge of the speakers and trainers.

The Valedictory Session was held with gracious presence of CS Chetan Patel – Chairman TEFC Committee Ahmedabad

Chapter.

The certificates were distributed to all SIP participants during the Valedictory session. The seven days training

was successful with great learning and fun. The total strength of the SIP batch was 137 participants.

Blood Donation Camp

The Ahmedabad Chapter of WIRC of ICSI in association with Act of Kindness (AOK) and Red Cross Society organized

Blood Donation Camp on Saturday, 16th/Feb/2014, from 09am to 01pm at Satellite, Ahmedabad under the co-ordination

of CS Aanal Satyawadi.

The Blood Donation Camp was based on the theme “Light up a lamp of life by donating Blood”.

CS Rajesh Tarpara, Chairman, Ahmedabad Chapter of WIRC of ICSI, CS Ravi Kapoor, Past Chairman, Ahmedabad Chapter

of WIRC of ICSI, CS Suresh Gondalia along with few CS students participated actively in the Blood Donation Camp.

STUDY CIRCLE MEETING

The Ahmedabad Chapter of WIRC of ICSI organized Study Circle Meeting on Saturday, 08th/Feb/2014 from 6pm to 8pm

with PCH=01 at Ahmedabad Chapter premises.

The meeting was addressed by Mr. Jigar Shah – Advocate, Gujarat High Court, Ahmedabad on topic “Overview of Service

Tax & its implications on Professionals”. Mr. Jigar Shah has a wide experience and exposure in the field of Service

Tax.

The meeting was full of knowledge for all participants including Members and Students comprising of total attendance

approx. 154 nos.

PRESS RELEASE

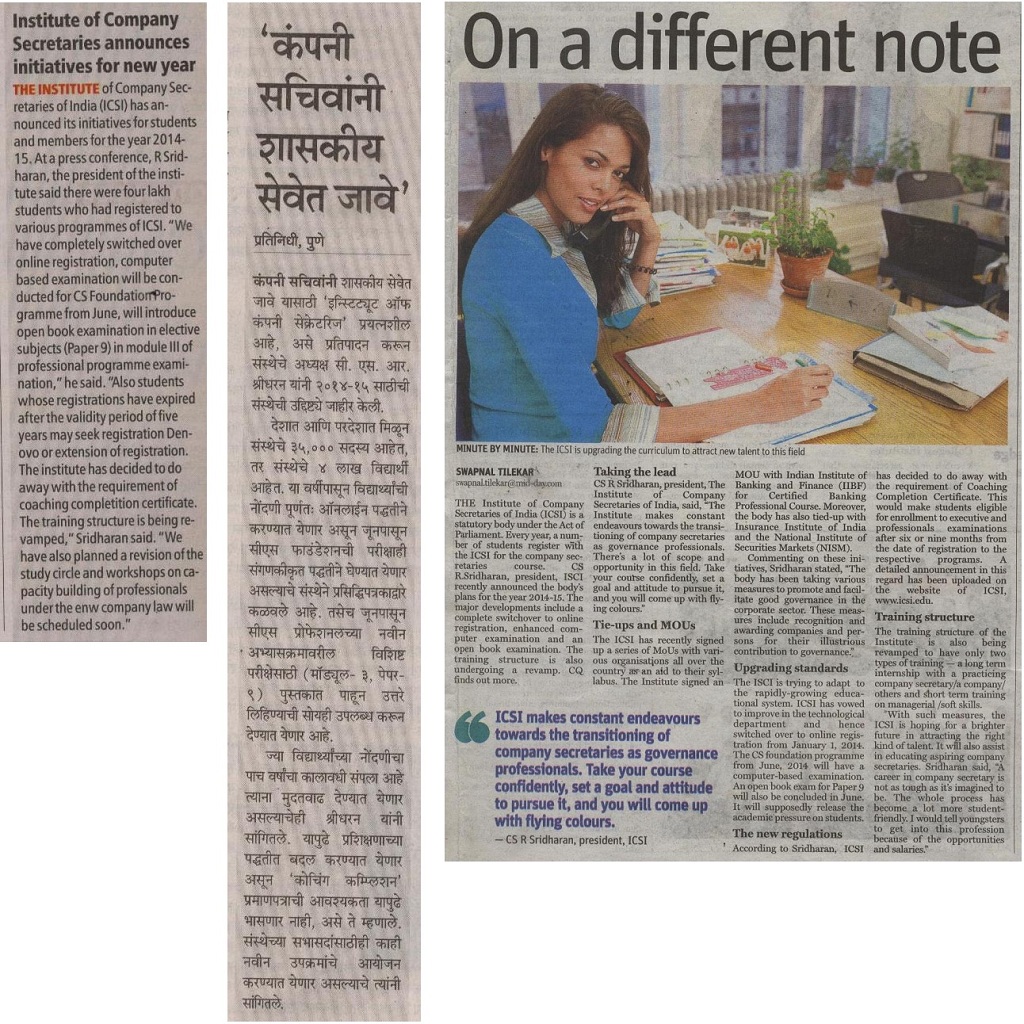

COMPANY SECRETARIES EXAMINATIONS RESULT on 25th FEBRUARY, 2014

Company Secretaries Examinations Results December, 2013

The results of : (i) OMR Based Foundation Programme; (ii) Executive Programme (Old and New Syllabus); and (iii)

Professional Programme examinations held in December, 2013 have been declared today, the 25th February, 2014 at

New Delhi and released to all the Regional and Chapter Offices of the institute throughout the country for information

of students and general public. In addition to making available results along with subject wise break-up of marks on

the institute’s website — www.icsi.edu the ICSI has extended the facility of downloading of e-result-cum-marks statement

by the examinees of Foundation Programme and Executive Programme (Old and New Syllabus) examinations. The results are

sent through e-mail to such of those students who had registered their requests along with their e-mail ids on the

Institute’s website.

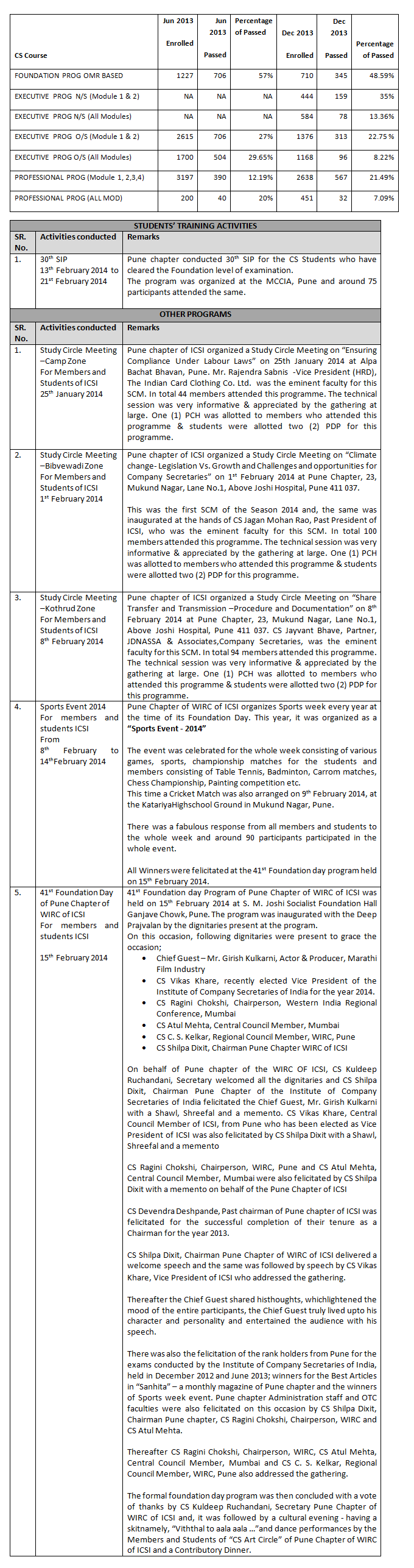

COMPARISON OF CS EXAM JUNE 2013 WITH CS EXAM DEC 2013 RESULT

Media Coverage

Chapter - Photo Gallery

WIRC - Photo Gallery

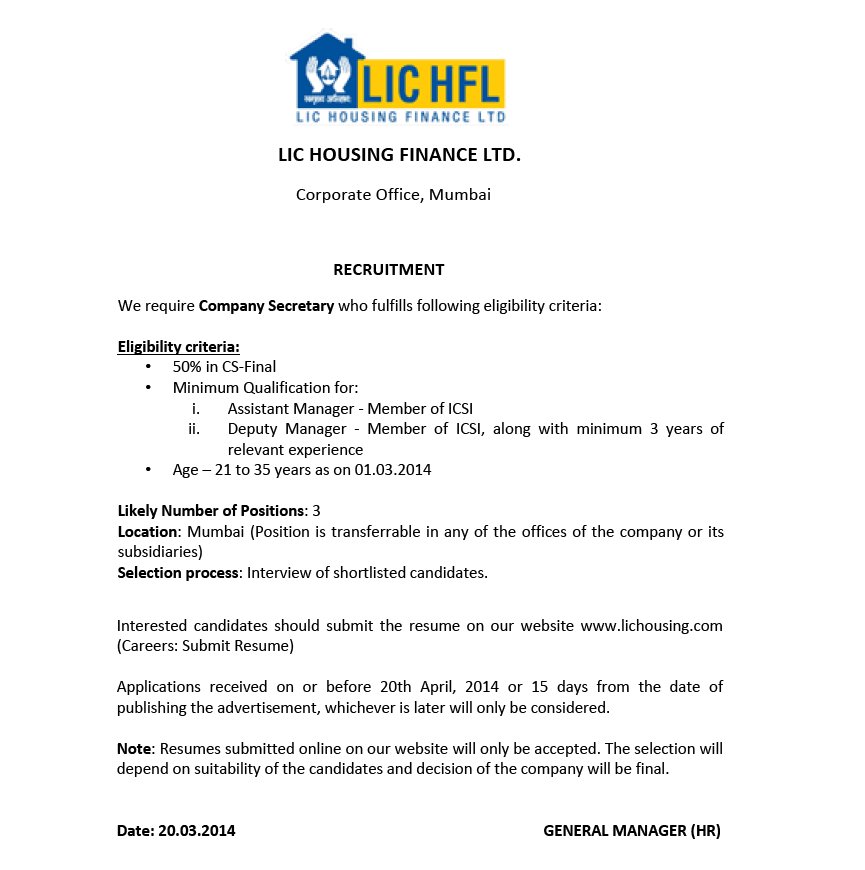

Paid Advertisement

Editorial Policy

A : “FOCUS” published monthly as a magazine aims to be a forum for members of the Western India Regional Council of the Institute of Company Secretaries of India ( WIRC of ICSI) for;

a. DISSEMINATING information,

b. COMMUNICATING developments affecting the Institute and its members in particular and the CS profession in general,

c. ARTICULATING issues of contemporary concern to the members of the profession.

d. CEMENTING and DEVELOPING relationships across membership by promoting discussion and dialogue on professional issues.

e. DISCUSSING and DEBATING issues particularly of public interest, which could be served by the CS profession.

f. FACILITATING Members of the profession to share their views on matters of professional interest by way of articles and write-ups.

B : The WIRC of ICSI recognizes the fact that;

a. There is a growing emphasis on the globalization of the CS profession;

b. There is an imminent need to position the profession in a business context which transcends the traditional and specific CS applications.

c. The Institute members increasingly will work across the globle and in global context.

C : Given this background the WIRC of ICSI strongly encourage contributions from the following groups of professionals;

a. Members of other Professional bodies across the globe

b. Regulators and Government officials

c. Professionals from allied professions

d. Academia

e. Professionals from other disciplines whose views are of interest to the CS profession

f. Business leaders

D : The magazine also seeks to keep members updated on the activities of the Institute including events on the various practice areas

and the various professional development programs on the anvil.

E : The WIRC of ICSI while encouraging stakeholders as in Section C to Contribute to the Magazine , it makes it clear that responsibility

for authenticity of the contents or opinions expressed in any material published in the Magazine is solely of its author and the WIRC of ICSI,

council members, any of its editors or members of Editorial Team & Advisory Board, the staff working on it or “FOCUS” is in no way holds

responsibility there for. In respect of the advertisements, the advertisers are solely responsible for contents of such advertisements

and implications of the same.

F : Finally and most importantly WIRC of ICSI strongly believes that the magazine must play its part in motivating students to grow fast as

Members of tomorrow to be capable of serving the Legal & Compliance area within ever demanding customer expectations.

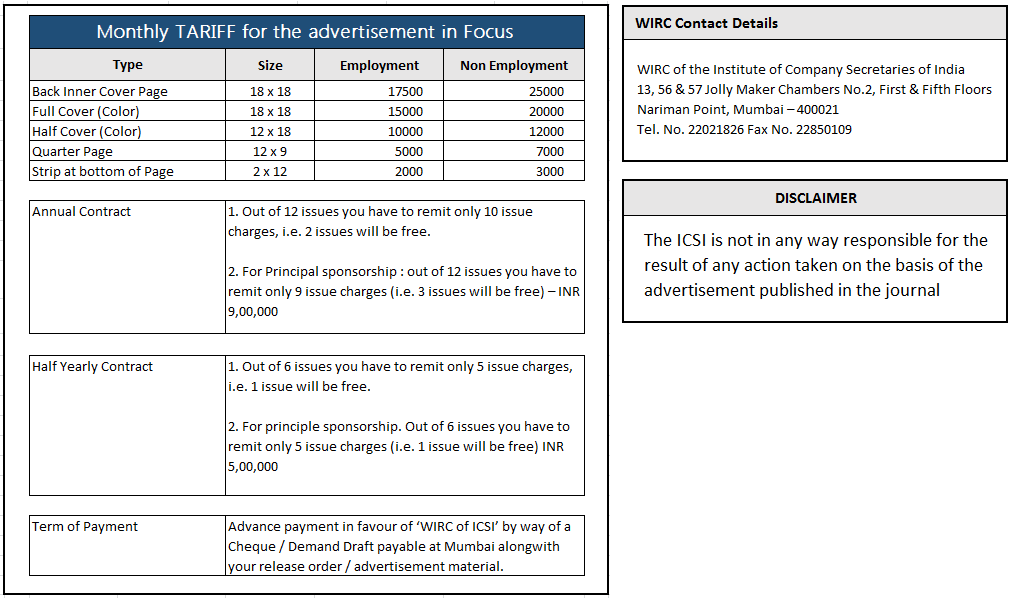

Tariff/Disclaimer

Previous Editions

June 2013

July - August 2013

September 2013

October 2013

November 2013

December 2013

January 2014